|

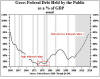

The interest rates will rise as a consequence

of Quantitative Easing and the explosive debt situation.

Although we cannot compare the actual situation with the 1920-30’s (in those

days the creation of money and credit was limited by Gold), I am convinced we

shall see a similar evolution of the Bond markets. See how FAST Bonds drop once

the down wave has been initiated (example Greece). The interest rates will rise as a consequence

of Quantitative Easing and the explosive debt situation.

Although we cannot compare the actual situation with the 1920-30’s (in those

days the creation of money and credit was limited by Gold), I am convinced we

shall see a similar evolution of the Bond markets. See how FAST Bonds drop once

the down wave has been initiated (example Greece).

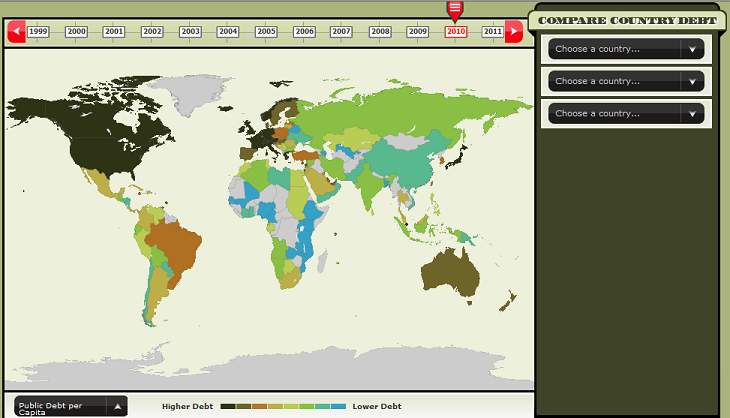

Governments can print exponential amounts

of Money but only so much DEBT can been created...See the economist for the

World's Debt situation...more

|

This is how it was during the last Great

Depression:

There are a number of reasons why

Treasury bond yields and the yield curve in general are likely to rise

sharply in 2010:...we have now (December 2009) broken through C and did break

down!

January 14, 2010 - This is how it is NOW in the

USA - see how similar with the Great Depression!!!

This is how it

will be during this Great Depression:

We have GLOBAL MARKETS. The

situation as described for the US is similar for the

EU.

Authorities can manipulate interest rates in the

short run and try to delay a rise in interest rates only for so long.

But this is the only action which is

possible. The world financial markets finally decide and dictate Interest

rates. What we are about to see is that Long term interest rates will push

up short term rates. The resistance level is 4,60% and it is in the

process to being broken. Notice the significance of the 4.0%

level. A huge reversal pattern is underway. The critical right side

resistance level has been 3.9%, well defended. The left side critical

resistance level has been 4.0% and 4.1% from late 2008. The trend is up,

accentuated by the stochastic index since October. Watch a breakout above

the important 4.0% level.

·

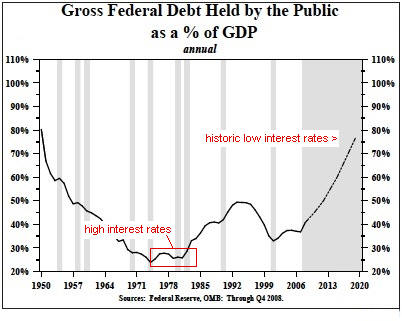

Huge borrowing requirements:

US treasury

borrowed over $1 trillion in the year to September 2008; it is expected to

borrow close to $2 trillion in the year to September 2009. That’s 13% of

US Gross Domestic Product. Not all of this is deficit; about $500 billion

is refinancing and another $500 billion is for bailout schemes, some of

which the US taxpayer may eventually see back. Still, in terms of GDP

that’s far more debt than the US capital market has ever been asked to

absorb, other than during World War II. At some point, “crowding out” must

occur; we certainly cannot assume that Asian central banks will want to

take the entire load, at interest rates less than zero in real terms.

· (Hyper)

Inflation.

The Fed appears to believe that the current recession will

bail the United States out of its inflation problem. The example is given

of Japan in the late 1990s, after which the Fed explains that they will

avoid the mistakes of the Bank of Japan, thus preventing damaging

deflation. Actually that seems to be wrong on two counts. The main mistake

in 1990s Japan was not monetary but fiscal; government spending was

allowed to expand inexorably, producing ever larger and larger deficits.

That mistake appears to be only too likely to be repeated here. The

difference is that the United States currently has a 1% Federal Funds rate

and 5% inflation, the approximate opposite of Japan in the early years of

its slump. With M2 money supply (the one the Fed will divulge) up at an

annual rate of 18.3% since the beginning of September it seems likely that

inflation will accelerate – as it did in the recessions of 1973-74 and

1979-80.

·

Rising real rates of return.

The yields on Treasury Inflation

Protected Securities have already risen from just over 1% to nearly 3%

since the beginning of 2008. Given the excess of bonds coming to the

market, it makes sense that real yields should rise. That in itself

suggests that conventional Treasury bonds are hopelessly overvalued – with

the 10-year TIPS yielding 2.82% and the 10 year Treasury 3.78% (yields as

of November 02 are even lower), the implied rate of US inflation over the

decade to 2018 is 0.96% per annum, for a total rise in prices by 2018 of

less than 10%. If you think that’s likely, I can get you a deal on

Brooklyn Bridge!

Thus Treasury bond and other prime bond yields can be expected to rise

sharply in 2009/2010/2011. This will cause losses to their holders. To the extent

that such holders are foreign central banks, the United States probably

doesn’t need to worry. Foreign central banks have been gentlemanly holders

of US debt through periods such as 2002-08 when the dollar has

depreciated; a rise in interest rates simply gives them another way of

making a loss. Personally if I were the Chairman of the People’s

Bank of China and Treasuries had lost me the kind of money they have in

the last five years I’d probably declare war on the US, but fortunately

central bankers are a phlegmatic and tolerant lot!

However domestic holders are a more serious problem. To the extent that

pension funds have losses on their holdings of bonds, they will need

to raise contributions; to the extent that insurance companies have

such losses they will need to raise premiums. Some entities will be

hedged, but by doing so they will have simply transferred the interest

rate risk to somebody else; by definition of derivatives the total

outstanding derivatives position must be zero, however large the

individual positions taken.

Assuming the $30 trillion state, mortgage and private corporate debt

outstanding has an average duration of 5 years, a fairly conservative

assumption, and neither the shape of the yield curve nor the premiums

payable for risk alter significantly by the end of 2009, a 1% rise to

4.74% in Treasury bond rates by December 2009 would cause a total loss to

investors in the $30 trillion of Federal, agency, mortgage and prime

corporate debt of 3.9% of the debt’s principal amount, or $1.17 trillion.

Not as bad as the credit losses.

However once rates start rising, they are likely to rise much more than

1%. To cause a loss of $3 trillion, the same as the estimated credit

losses, 10 year Treasury bond yields would have to rise to 6.43%. Hardly

an excessive assumption; 10-year Treasuries yielded 6.44% on average

during 1996, at the beginning of the Fed’s money bubble, in which year

inflation was 3.4%.

More extreme moves are certainly possible. In 1990, 10-year Treasuries

yielded an average of 8.55%, while inflation in that year was 6.3%. A rise

in the yield curve to an 8.55% 10-year Treasury yield would cost investors

$5.06 trillion, almost double the credit losses from subprime and its

brethren. Should we revert fully to the days when Paul Volcker was Fed

Chairman and get the 13.92% 10-year Treasury yield of 1981, a year in

which inflation was 8.9%, the cost to investors from the interest rate

rise alone (we can assume a few additional bankruptcies, I think) would by

$9.33 trillion, about two thirds of the current value of common stocks

outstanding and more than three times expected credit losses.

One can debate the probability of the various outcomes above. Inflation is

already around 5% and is unlikely to drop much, so the 1996 estimate for

the peak 10-year Treasury yield would seem low. On the other hand, while

inflation could well reach 8.9%, it seems unlikely that we will need to

push Treasury yields quite up to 1981’s Volckerian levels, at least not

within the next year. So the 1990 estimate is perhaps the best, involving

a loss to investors of around $5 trillion or a little over. Such a loss

will produce fewer calls for bailouts than the $3 trillion credit losses,

but just as much economic damage, albeit much of it unnoticed by the

general public.

|

To receive zero percent interest after

loaning your money to the government for one month is ridiculous.

Government

typically follow the 'Turkey pattern'.

They pretend to care for the people during the 1000 first days but the next day

they are slaughtered. If they can't inflate away the debt, they call for a

debt moratorium. In Belgium 'the Unified debt-1945' is know of all

financial people. Government

typically follow the 'Turkey pattern'.

They pretend to care for the people during the 1000 first days but the next day

they are slaughtered. If they can't inflate away the debt, they call for a

debt moratorium. In Belgium 'the Unified debt-1945' is know of all

financial people.

During the Great Depression, all the conservative investors who held Bonds

lost all their savings as Bonds were either called in under the Moratorium

(Europe) or as the Dollar was devalued by 40% by Roosevelt.

The reduction in interest rates

which we have seen in the 1990's in Japan

and more recently in Western economies should theoretically stimulate demand to

reduce deflationary pressures. This however is not happening.

Monetarism does simply not work.

Investors are buying dangerous Government Debt

yielding less than safe Real Assets (Stocks)!?

Many who claim that there is justification for

today's bond yields are the same folks who claimed back in 2006 that home prices

had never before in history declined on a national level and any talk of a

bubble in real estate was therefore nonsense. Many of them are also the same

people who assured you in the year 2000 that prices of internet stocks were

fairly priced.

Rising interest rates are likely to be

symptomatic of the coming cash crunch. The revenue streams of the banks will dry

up and the industry will end up in an even worse shape.

Note how in from 1973 to 1980 interest

rates rose to peak in 1981 and the price of GOLD rose and peaked at the same

time. Or how this proof you have a

'Problem' if you are holding on to Bonds NOW!

|

> back to Bonds

© -

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |