"The great depression was produced by

government mismanagement rather than by any instability of the private

economy" M. Friedman

The original idea of

having a central bank was to secure stability by ensuring politicians

kept their hands out of the pockets of the Treasury. The reality is

different. Over the past decennia politicians have tried to avoid

recession at all costs by increasing the money supply through the

creation of debt, which in turn serves as a reserve for (Central)banks.

Now that the debt has become a bubble it becomes impossible for the

economy to honor it and a natural process of debt destruction has been

initiated. Greece and Lehman Bros are two excellent examples.

Dramatic is that because

of the size of the debt not even a balanced budget can and will bring

relief. Interest on existing debt will continue to rise as a percent of

total government expenditures. The higher the general level of interest

rates, the faster the total of interest charges will rise - and this is

why the FED is converting short term debt into long term debt and why

the ECB and the FED are keeping interest rates as low as practically

possible. If interest go up to for example 12% it would add another

trillion deficit. [Imagine what is happening in Greece where interest

rates on 10 year Greek treasuries are 24%]

It is the accumulated

interest expenditure which will in the end bring the system down as the

only way to bring down interest expenditures is to redeem the debt. Any

other popular measures like cutting spending, raising taxes, save on

energy only result in a further reduction of economic activity and this

in turn results in yet another reduction of tax revenues making it the

Authorities even harder to pay for the interest on its debt.

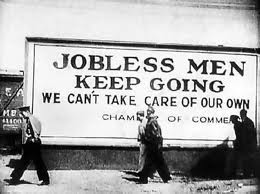

As a result of the

economic decline, unemployment is on the rise and people start to

riot...Bankers and Politicians must at a certain point fear for their

lives (Argentina).

Destruction of debt

equals destruction of Money and less money chasing a same amount of

goods result in lower nominal prices for Investment instruments. Most

dangerous however are Treasuries (which will end worthless) and ANY

investment instrument which is guaranteed by Treasuries: life

insurances, pension funds, bank deposits, saving accounts, bank shares,

e.o.

Add $ 1.4 quadrillion

derivatives (uncontrolled, bank manufactured and bank controlled

investment instruments) and we have a financial atomic bomb. Most people

don't even realize they hold directly or indirectly these kinds of

investment instrument as these are usually sold as ZERO risk paper.

Remember it was Derivatives which brought down Greece in the 1st place.

This poisonous cocktail

will cause a lot of harm and when it all blows up there will be those

who loose it all and those who loose part. Important is to be OUT of

anything which appears to be safe like: Treasuries, bank deposits,

zero-risk bond and stock funds, money market funds, TAK-instruments,

life insurances, financial stocks, ....and to hold Real Money as well as

certain well defined Real Assets (Real Estate is a HOCG and won't do

unless you buy it cheap at the bottom of the market).

Dramatic is that

Authorities are because of their acts punishing the very ones who have

been working and saving their whole life: pensioners and savers.

Europe has a serious

additional problem: society has for decennia been poisoned and

brainwashed by socialism. Society is over-regulated and for this reason

any natural adjustment becomes extremely difficult. If the mentality of

the people doesn't change we may well end up with a remake of the Dark

Ages of Europe when India became the Financial Capital of the world.

Note: Money is a natural

derivative of Bonds and the 1st paper money was interest

bearing.

October 6, 2011

Francis D. Schutte and

the Goldonomic Team