|

Updated May 2011

Fortunes to be lost and

fortunes to be made. The

Tulip mania of 1637,

John Law's "Mississippi Scheme" of 1720, and the dot-com / tech

bubble of 1999 will pale by comparison. Even the hyperinflation in

Weimar Germany in 1923 and the

Great Depression will seem like

a walk in the park compared to what is coming.

-

High time to get educated. Read

books and newsletters on the subject and decide for yourself. Stop

believing the nonsense told by talking heads, politicians and Bankers.

-

Buy physical gold and silver and

take possession of it (or have it stored at a third party depository).

-

Avoid "Fools gold" such as:

ETF's, pool accounts, futures contracts, leveraged accounts etc.

-

Don't buy investment instrument you

don't fully understand. Certainly not if they are sold by renowned

banks.

-

Don't buy investment instruments

where you can't loose! Such instruments are based on derivatives,

CREDIT DEFAULT SWAPS and are extremely hazardous to your wealth. NO

INVESTMENT is RISK FREE!

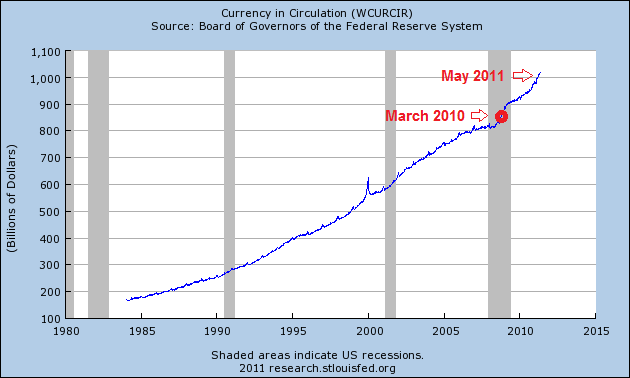

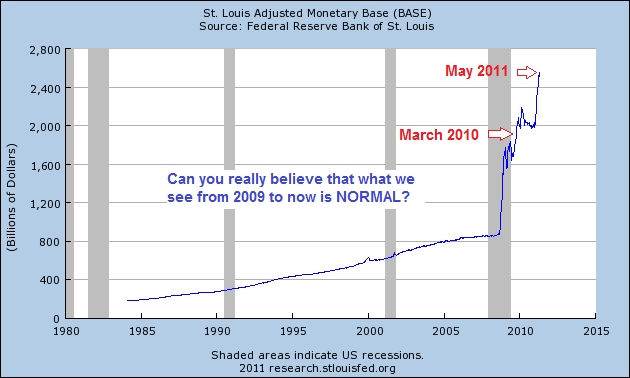

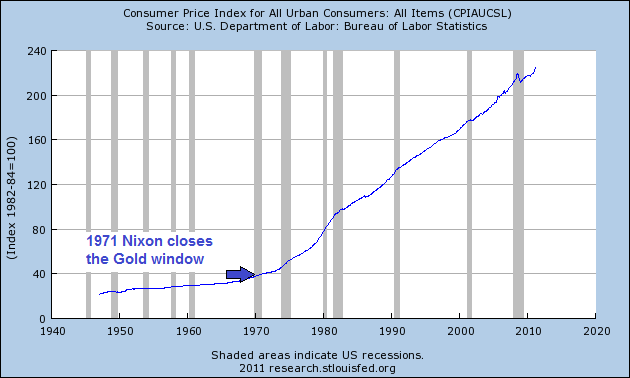

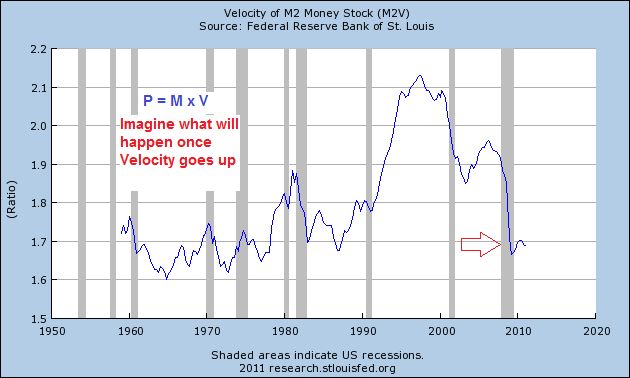

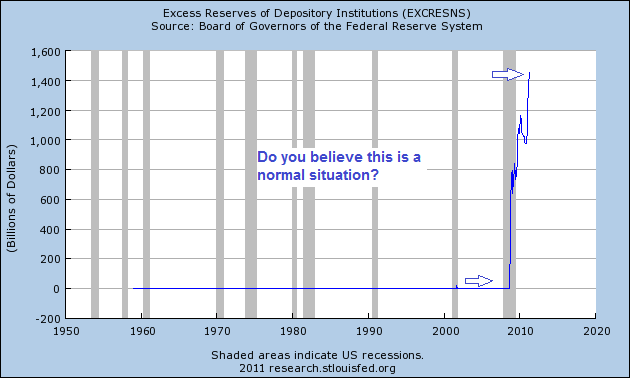

In a few years a chart of the

price of gold will look similar to the following charts, and a chart of

the U.S. dollar will look like one of these charts flipped upside-down.

We have tried to find similar

data and charts from the ECB...impossible as they act in a traditional

secretive way. We assume that charts and figures will be similar.

Every time governments, and/or

the banking system, abuse a currency enough to push it to a tipping point (such

as in these charts), the free market and the will of the public revalue gold and

silver to account for the excess currency that was created since the last time

they were revalued. But this time, for history to repeat, and for gold to do

what it did in 1980, 1934, and hundreds of times throughout the world going all

the way back to Athens in 407 BC, it will require a gold price of over $10,000

per ounce... And that's if they turn off the printing presses today!

>back to

newsletters

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491

|