|

Updated

November 18, 2009 Updated

November 18, 2009

You

just know that something is astray when Afghan poppy growers begin to switch

from opium to wheat (The Independent). And this is exactly what they are

doing!

According

to an official UN report, opium production in Afghanistan has risen

dramatically since the downfall of the Taliban in 2001. UNODC data shows

more opium poppy cultivation in each of the past four growing seasons

(2004-2007), than in any one year during Taliban rule. More land is now used

for opium in Afghanistan, than for coca cultivation in Latin America. In 2007,

93% of the opiates on the world market originated in Afghanistan. This is no

accident. According to Afghan

sources, president Karzai used to work for the CIA and is the Opium

“Godfather” of Afghanistan today.

The aim of the US bases in Afghanistan is to be able to strike at the two

nations (Russia and China) which represent the only combined threat in the

world today to the USA.

Russia

is a nuclear power and it holds the world’s largest treasure of natural gas

and vast reserves of oil urgently needed by China. The two powers are

increasingly converging via a new organization they created in 2001 known as

the Shanghai Cooperation Organization (SCO). That includes as well as

China and Russia, the largest Central Asia states Kazakhstan, Kyrgyzstan,

Tajikistan, and Uzbekistan.

Afghanistan has historically been the heartland for the British-Russia Great

Game, the struggle for control of Central Asia during the 19th and early

20th Centuries. British strategy then was to prevent Russia at all costs

from controlling Afghanistan and thereby threatening Britain’s imperial crown

jewel, India.

Afghanistan lies along a proposed oil pipeline route from the Caspian Sea oil

fields to the Indian Ocean, where the US oil company, Unocal, along

with Enron and Cheney’s Halliburton, had been in negotiations

for exclusive pipeline rights to bring natural gas from Turkmenistan across

Afghanistan and Pakistan to Enron’s huge natural gas power plant at Dabhol

near Mumbai.

The problem

for the US elites around Wall Street and Washington is the fact that they are

now in the deepest financial crisis in their history. It is now clear to the

entire world this Elite [and Globalism] is fighting for self-survival. This is

demonstrated by the arbitrary exercise of power by non

elected officials such as Treasury Secretaries Henry Paulson and now Tim

Geithner, stealing trillion dollar sums from taxpayers without their consent

in order to bailout the bankrupt biggest Wall Street banks, banks deemed “Too

Big To Fail” .

Just like Britain and the USSR before it collapsed the

USA finds itself in a similar situation where the financial means (each

Private costs $ 750,000 per year) start to dwindle away...

_____________

According to

the World Bank, just over 1 billion people live on one dollar or less per day.

People in the poorest countries in the world spend 80% of their income on

food. Chinese consumers spend 28% of their income on food. In India it is 33%.

Belgium, France and the Netherlands spent about 14 % of their income on food.

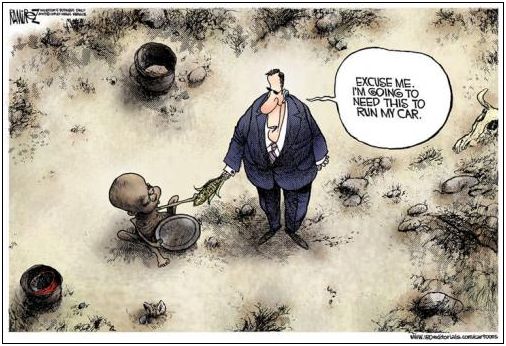

In promoting

bio-fuel as an ultimate effort to break the fuel shortage, politicians

have opted for an acceleration is the price of food commodities.

According to a

recent UN report, it takes 232 kg of corn to fill an average 50 liter car tank

with ethanol - enough corn to feed a child for an entire year. It is estimated

that almost 20% of total US corn production will go towards ethanol this year

and the number is set to rise to 45% by 2015. Hence, in promoting bio-fuel as

an ultimate effort to break the liquid fuel shortage, politicians are

accelerating the price of all food commodities that are already – as a result

of the monetary inflation – rising exponentially.

According to Goldman

Sachs, the cost of ethanol from corn is now over $80 per barrel, it is about

$145 from wheat and over $230 from soybeans. Only Sugar (grown and used in

Brazil and South Africa) cane ends up costing $35 per barrel. Conclusion,

politicians must be aware that the price of crude oil will never fall back

under the $ 80 per barrel. This has huge implications as oil and natural gas

are used to manufacture a broad range of products: from fertilizers to

plastics.

Not only is the

demand rising but the supply and the cost (fertilizers, energy, etc.) to grow

Food commodities is dramatically increasing. Sometimes the price of

fertilizers is that high that farmers cannot afford (Africa) to buy them.

Inflation is there to

stay and though a financial impact of Hedge funds and other speculators cannot

be denied, all Food commodities are in a secular UPTREND and will remain there

for the years to come. Sooner or later we shall see the word Hyperinflation

rather than the word Inflation in the headlines of the Media.

>back to newsletters

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |