|

Updated July 1, 2011 - There are very few

options to deal with the overwhelming debt burden in most countries: raise

taxes, cut spending, increase growth, or print money. Guess which one is

more likely? Inflation from currency dilution is baked in the cake and

will spur further gold demand and light a fire under the price.

|

10-Year U.S.

Treasury Note Rate |

Federal

Government Debt as a % of Gross Domestic Product |

|

|

|

|

|

|

A historic

bottom |

|

February 14, 2011 - Public debt to Gross Domestic

Product - The Debt is the problem, not the economy. Once public debt is

100% and more of GDP there is a VERY SERIOUS problem.

January 13, 2011 - This is how fast long term interest rates rise in

Italy, Spain and Portugal. Rising long term interest

rates are the prelude to a default of Greece, Portugal and Spain...BEFORE

these countries do, they will have to leave the EURO.

|

Italy 10 y Gov. bond yield |

Spain 10 y Gov. bond yield |

Portugal 10 y Gov. bond yield |

Belgium 5 y Gov.

bond yield |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

January 1, 2011 - Falling income (taxes) and rising expenditures leave the

Authorities no other choice but to print money (QE) and makes it

impossible to mob up the money.

December 18, 2010 - This is how the basic mechanism for Bonds works -

[This example doesn't take into account the yield to

maturity] -

Yield

to maturity

Assume you sign in or

buy a Bond/Treasury yielding 3% maturing in 2020 (10 years) at 100

(nominal value) and the redemption price also is 100%.

* You invest $

10,000 x 100% = $10,000 . Each year you will receive $ 300 interest.

-

If interest rates stay constant for the

next 10 years, the market value of a Bond ABC 3% 2020 will remain

the same or 100% and the nominal value paid back to the bond holder in

2020.

-

If however interest rates rise to 6%,

the market value of the 3 % ABC Bond will fall until it also yields 6% or

by 50%..

-

Each buyer of the new issued 6% XYZ bond

pays $ 10,000 x 100% = $ 10,000 and receives 6% or $ 600 interest

per year.

-

For this to happen to the 3% ABC Bond the

price has to fall until each new buyer of this 3% bond also receives

$600 interest per year. Hence the price of our 3% ABC bond has to fall by

50%, allowing each new investor to buy $10,000 x 50% x 2 = Nominal $

20,000 bonds maturing in 2020 and paying 3% . [$20,000 of our 3% ABC bond

now also pays out $600 per year].

-

If interest rates continue to rise

like is now happening in Greece (12%) , your loss becomes a lot higher.

Assuming the interest rates rise from 3% to 12% , the 3% ABC Bond

price has now to fall until it also yields 12%. For this to happen the

price has to come down to 25% . Our 1st investor (3% bond ABC

maturing in 2020) now looses 75% of his capital. At 25% each new

investor can again buy the same yearly yield of $ 1200. In this case he

will buy a nominal amount which is four times higher: $ 40,000

nominal of Bond ABC @ 3% x 25% equals a $ 10,000 investment at 3%

which yields $ 1200.

Conclusion:

-

Because interest rates in Greece have risen

to 12% in just over one year, the Bond holder has lost 75% of his savings

which he eventually may recover in 2020 IF there is no DEBT MORATORIUM

between today and 2020 (something which is highly probable). If we have a

debt moratorium the Greek (or other bonds) bonds will be rolled over for

at least another 100 years and more at the same low 3% interest rate.

-

Assuming there is no debt moratorium

(best case scenario, we'l have a runaway and/or high inflation rate of

more than 10%. In this case the loss will be: 10% - 3% per year on

the interest (-7%) and an additional 10% per year on the capital...in

other words, not even peanuts will be left in 2020.

* note:

1. This is a simple calculation method.

Yield to maturity is different and slightly better than what we show in

our example but not taken into account as it is too difficult to explain

and understand. IF we have no debt moratorium the value of our 3%

ABC bond will go up by about 7.5% each year it is closing in 2020.

2. Bonds with adjustable rate or insured

nominal rate are most of the time insured by some dangerous uncontrolled

Derivative (Credit Default Swap).

3. To calculate the yield to maturity

one must make the difference between the market and redemption price,

divide it by the number of yours until maturity and add or subtract this

figure from the calculated yield.

December 2, 2010 - Japan is never mentioned...but their situation is bad,

bad, bad

|

Government Borrowing needs

(click on chart to enlarge) |

State deficits until 2012 |

|

|

|

|

|

|

|

|

|

|

|

|

October 26, 2010 - The manipulation of Bonds will continue until the

system falls apart..

-

"This is still a

bumpy road," said David Schnautz, a fixed-income strategist at

Commerzbank AG in London. "This kind of news is highly market-moving and

any relief we see in terms of spreads tightening is vulnerable."

-

The yield on

Portugal's 10-year bond increased 24 basis points, the most since

Sept. 20, based on closing prices, to5.93 percent as of 3:39 p.m. in

London. That left the extra yield, or spread, investors demand to hold

the bonds instead of similar German bunds at 328 basis points.

-

Greece's

10-year yield rose 79 basis points, the most since June 15. The spread

with bunds widened to 779 basis points, the most since Oct. 1. Ireland's

10-year bonds yielded 408 basis points more than similar bunds, up from

393 yesterday.

-

Portugal's

government and the opposition Social Democrats broke off talks on the

2011 budget proposal, which include plans for the deepest cuts since at

least the 1970s. There's "no possibility of continuing" negotiations,

Eduardo Catroga, a former finance minister who represented the rival

party in the discussions, said in Lisbon today. Prime Minister Jose

Socrates, lacking a parliamentary majority, needs the largest opposition

party to back the budget or abstain for it to be passed. The Social

Democrats have opposed tax increases and called for deeper spending

cuts. Portugal sold 611 million euros ($843 million) of bonds due in

2014 today, attracting bids equivalent to 2.8 times the amount offered,

down from 3.5 times in September.

April 2010 - The way Government debt exploded over the last 10 years

and the interest rates were pushed down at the same time, is nothing more

but a big HOLDUP of the savers. Already in 2001

we started to advise our friends to get into Gold (and out of fiat paper

money and bonds).

click on charts to

enlarge

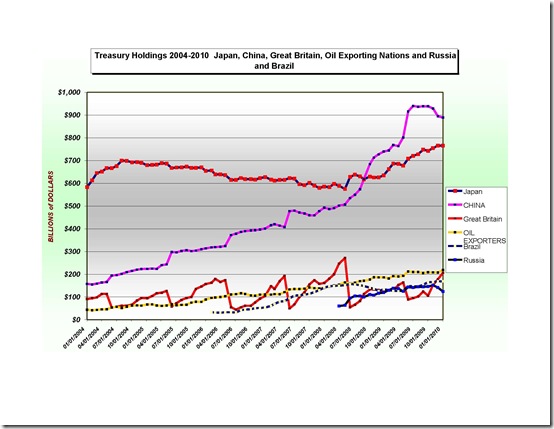

March 2010 - US Treasury holdings

Japan, China, Great Britain, OPEC, Russia and Brazil [interesting

is that the Treasury holdings of Britain (country which is virtually

bankrupt) has been going up whilst the holdings of China came down and

Japan was flat.]

February 18, 2010 -Bonds,

Gilts and Treasuries are nothing more but an option to buy worthless fiat

paper money.

Within the

next 12 months, the U.S. Treasury will have to refinance $2 trillion in

short-term debt. And that's not counting any additional deficit

spending, which is estimated to be around $1.5 trillion. Put the two

numbers together. Then ask yourself, how in the world can the Treasury

borrow $3.5 trillion in only one year? That's an amount equal to nearly

30% of our entire GDP. And we're the world's biggest economy. Where will

the money come from?

November 17, 2009

Government is growing the very Monster who

will destroy itself in the near future.

No Government has ever

paid off its debt. Government by increasing its debt consumes all

productivity of the country. In order to keep things going it wages a

war against it own manufacturing system and citizens by increasing

Taxation, Regulation and Inflation. As Capital is leaving the country

they even go after Capital which is being hidden in countries like

Switzerland and other Tax Heavens.

But as long as the

domestic situation doesn’t improve Capital continues to leave the country

and so further reduces the economic growth. This leaves the Government

with a greater deficit and even more must be borrowed and more taxes must

be voted into place (Green Taxation is better digested). It now has become

a vicious circle. This pattern will continue until the system collapses

like the USSR and China did in 1989 and Zimbabwe beginning of 2009. As the

system collapses it takes no prisoners and ‘all bond holders’ loose their

savings. Bonds and Fiat Paper money being the same ‘Assignats’ the latter

also looses its value and we have hyperinflation until it is replaced by

another instrument which is accepted by the market and a fresh cycle

starts….

In the past not only

did we see Bonds loose their value because of Hyperinflation (Weimar,

Zimbabwe) but in the end and even if we did not have a cycle of

Hyperinflation, Government repudiated on their debt or debt was erased

like it was in Zimbabwe beginning of this year. Such even happened with

Gold edged (Gold guaranteed) bonds issued by the USSR and China decennia

ago.

Today it is simply not

safe to keep your savings in Bonds. Not only do they pay a negative yield

because the Real Interest Rate is lower than the Inflation rate but Bonds

are also (because of manipulation by the Central Banks/Authorities who are

keeping interest rates artificially low) extremely expensive.

Similar

conditions apply to Bank deposits and Savings accounts and to any Fiat

Paper Money kept under your mattress.

Even worse is that

similar conditions apply for Life Insurance companies, Insurance

companies and Pension Funds as these are legally obliged to invest the

largest part of their reserves in (Government) Bonds. Not only will the

amount of retirees increase dramatically as Baby Boomers become inactive

but the means to receive decent retirement payments are being eaten away

by the REAL situation or Negative Real Interest Rates and Real Inflation.

To be safe one in fact

must keep his wealth in REAL ASSETS: commodities, Equities, Real Estate,

Gold and Silver (see our investment roster) and anything which is not

Paper Money, Paper bonds or guaranteed by these.

Updated October 27, 2009

-

2009 Government Bond auctions are failing

all over the Western world. German bond

auction failed in a warning for governments to raise record amount of

debt to stimulate the economy [January 7, 2009] and Britain

suffered its 1st failed Gilt (government bond) auction since 2002 [March 25,

2009]. In the USA the Fed is done the same and plans to monetize

$ 1050 billion by buying treasuries and Mortgage bonds.

-

Watch the parabolic runaway on

the P&F chart....January

20 the bond bubble has busted. Bonds will fall back to where this

move started in the first place. It only may take some time as the

authorities have opted for Quantitative Easing and are printing

the money they use to buy the bonds with. As a direct consequence, the

Bond markets won't be affected by the huge demand of the Authorities for

funds. Additionally, many mortgage owners see the finance cost of their

homes lowered. This should take some steam off the Real Estate markets.

The rise of interest rates is delayed, but for how long? Expect sooner

or later the hyperinflation will push them up strongly.

-

Bonds are a loose-loose situation.

Bonds ain't better than fiat paper money. Basically both are equally

DANGEROUS government debt. In the 1920's-30's most European countries

held a moratorium on their debt hereby chasing huge quantities of capital to the

US. President Roosevelt had no other option left but to call in Gold and

devaluate the Dollar by 40%. Bonds are either the subject of a moratorium

or their value is inflated away.

-

Who in their right mind would flee to bonds when the Fed

is in the process of

bailing out Wall Street?

Does nobody remember what happens

over and over again with Government debt?

Buffet is 100% OUT of

US treasuries. He knows what is coming. We know it too!

-

In an ultimate Japanese style effort to keep the economy alive:

30 year yields are still at historic low levels. Today these are so low

that after commission the nominal Yield has become negative. Add the

real inflation rate of 12% and the loss becomes a dramatic 10% y/y! One

has to be crazy to buy some...

-

Bonds are

a loss-loss situation. In a hyperinflation, the

financial markets break down and bonds become worthless. In case of a

deflation, the Authorities repudiate their debt by a Moratorium.

-

2008 there is a huge quantity of government

debt building up in the pipeline,

and the government bonds due to be issued in the

fourth quarter and early next year will only add to the problems some

countries are facing, and particularly those countries like Greece and

Italy who already carrying large

amounts of debt that needs to be refinanced or rolled over. It has been

estimated that European government bond issuance will rise to record levels of

more than €1,000bn in 2009 (30 per cent higher than 2008)! 2009 it has become

clear that ALL GOVERNMENTS will use Quantitative Easing = Print

money to finance their deficits.

-

Quantitative Easing = monetization of DEBT

or the Authorities are PRINTING money to pay the bills.

-

30 Year Bonds will tell us when the

Hyperinflation takes off. The important level is

4.3%..right where we are NOW. Break it and kiss the Bonds good-bye.

-

Interest rate cycles last on average 25/27 years.

Last time the interest rates bottomed was in 1981. Add 27 and you have

2008 or exactly the last top of the Bond market. Once the Bond market

wakes up, it will be Game over. Important levels are 3,40% for 10 year

yields and 4.30% for 30 year yields.

-

Interesting is that once again the British Gilt market

(treasuries in the UK used to be gold guaranteed in the old days...and

this gave them the name GILT) is a precursor of what is happening in the

USA and also in the EU.

July 20, 2009

The world is going to need

to find $5 trillion to finance government debt issuance. Additionally we

need to fund private business (Corporate debt) and consumer debt.

Where is all this money going to come from?

June 8, 2009

The soaring bond yields and

mortgage rates will wreak havoc on the debt-imbued economy.

Already we saw a report by the Mortgage Bankers Association showing a drop

of 16% in the Refinance and Purchase Index for the week ending May 29th.

For an economy that has a total debt to GDP ratio of 370%, we can also

expect dire repercussions in everything from credit card loans to

municipal bonds.

Authorities can only

control (manipulate) interest rates so long...In the long run the market

forces always kick in.

Updated

January 22, 2009

In an economy saddled with

fractional

reserve banking, commercial banks are guaranteed by a central banks willing to

buy any debt securities and to

provide other loans at

below market interest rates (with money the central bank creates out of

nothing) the market restraints are replaced by opposite forces.

For most of the investors it creates a

false signal which encourages the malinvestments of capital. In other words, at

some point they discover (the real estate sector)

that their increased goods production can only be sold at distressed prices and

that this forces them into bankruptcy (examples:

the builders,

financial institutions that provided the mortgages)…

Worse is that artificial low interest rates

discourage savings and encourage borrowing on the part of the public and

encourage consumption. This is exactly the opposite of what should happen in a

sound economic system.

Massive borrowing makes credit less

available to already overextended consumers. By the time the buildings (real

estate) and capital equipment (China, India) are completed, the consumer has run

out of steam. Inventories pile up. Production is cut back. Capital good (HOCG)

orders are cancelled. Factories are closed and people laid off. Consumer demand

falls even more. Everyone has liquidity problems. The credit boom has become a

depression.

The depression also reduces the tax

revenues of government at a time where government expenditures (unemployment

compensation) increase. In other words, the government deficit grows

mightily at the very time where consumers and industry are squeezed financially.

Because of a hike in demand for money and credit, interest rates soar in a

cycle of hyperinflation and Bonds and fiat money become worthless.

January 9, 2009 -

German bond sale’s fate signals trouble ahead

By David Oakley in

London

Published: January 7 2009 13:30 | Last updated: January 7 2009 20:45

A German sovereign bond

auction failed on Wednesday as investors shunned one of the most liquid

and safe assets in the world in a warning for governments seeking to raise

record amounts of debt to stimulate slowing economies.

The fate of the first Euro

zone bond auction of 2009 signals trouble ahead as governments around the

world hope to issue an estimated $3,000bn in debt this year, three times

more than in 2008.

December 19, 2008

|

American bankers are so fearful of a

replay of the 1930's Great Depression, they've finally reached the point

of "No-return," - lending $30-billion to Uncle Sam at a rock-bottom

interest rate of zero-percent. Demand was so great at the last auction;

the Treasury could have sold four-times as many T-bills. If short-term

T-bill rates go negative, frightened bankers would effectively be paying

the US Treasury. for the privilege of lending money to it!

The last time short-term T-bill rates

went negative was during the Great Depression, when frightened bankers

were effectively paying the US Treasury for the privilege of lending

money to it! |

There are a number of

reasons why Treasury bond yields and the yield curve in general are likely

to rise sharply in the USA in 2009:

· Borrowing

requirements. Treasury borrowed over $1 trillion

in the year to September 2008; it is expected to borrow close to $2

trillion in the year to September 2009. That’s 13% of US Gross Domestic

Product. Not all of this is deficit; about $500 billion is refinancing and

another $500 billion is for bailout schemes, some of which the US taxpayer

may eventually see back. Still, in terms of GDP that’s far more debt than

the US capital market has ever been asked to absorb, other than during

World War II. At some point, “crowding out” must occur; we certainly

cannot assume that Asian central banks will want to take the entire load,

at interest rates less than zero in real terms.

· Inflation. The Fed appears to believe that the current

recession will bail the United States out of its inflation problem. The

example is given of Japan in the late 1990s, after which the Fed explains

that they will avoid the mistakes of the Bank of Japan, thus preventing

damaging deflation. Actually that seems to be wrong on two counts. The

main mistake in 1990s Japan was not monetary but fiscal; government

spending was allowed to expand inexorably, producing ever larger and

larger deficits. That mistake appears to be only too likely to be repeated

here. The difference is that the United States currently has a 1% Federal

Funds rate and 5% inflation, the approximate opposite of Japan in the

early years of its slump. With M2 money supply (the one the Fed will

divulge) up at an annual rate of 18.3% since the beginning of September it

seems likely that inflation will accelerate – as it did in the recessions

of 1973-74 and 1979-80.

· Rising real rates of return. The yields on Treasury Inflation

Protected Securities have already risen from just over 1% to nearly 3%

since the beginning of 2008. Given the excess of bonds coming to the

market, it makes sense that real yields should rise. That in itself

suggests that conventional Treasury bonds are hopelessly overvalued

– with the 10-year TIPS yielding 2.82% and the 10 year Treasury

3.78%, the implied rate of US inflation over the decade to 2018 is 0.96%

per annum, for a total rise in prices by 2018 of less than 10%. If you

think that’s likely, I can get you a deal on Brooklyn Bridge!

Thus Treasury bond and other prime bond yields can be expected to

rise sharply in 2009. This will cause losses to their holders. To

the extent that such holders are foreign central banks, the United States

probably doesn’t need to worry. Foreign central banks have been

gentlemanly holders of US debt through periods such as 2002-08 when the

dollar has depreciated; a rise in interest rates simply gives them another

way of making a loss. Personally if I were the Chairman of the People’s

Bank of China and Treasuries had lost me the kind of money they have in

the last five years I’d probably declare war on the US, but fortunately

central bankers are a phlegmatic and tolerant lot!

However domestic holders are a more serious problem. To the extent that

pension funds have losses on their holdings of bonds, they will need to

raise contributions; to the extent that insurance companies have such

losses they will need to raise premiums. Some entities will be hedged, but

by doing so they will have simply transferred the interest rate risk to

somebody else; by definition of derivatives the total outstanding

derivatives position must be zero, however large the individual positions

taken.

Assuming the $30 trillion state, mortgage and private corporate debt

outstanding has an average duration of 5 years, a fairly conservative

assumption, and neither the shape of the yield curve nor the premiums

payable for risk alter significantly by the end of 2009, a 1% rise to

4.74% in Treasury bond rates by December 2009 would cause a total loss to

investors in the $30 trillion of Federal, agency, mortgage and prime

corporate debt of 3.9% of the debt’s principal amount, or $1.17 trillion.

Not as bad as the credit losses.

However once rates start rising, they are likely to rise much more than

1%. To cause a loss of $3 trillion, the same as the estimated credit

losses, 10 year Treasury bond yields would have to rise to 6.43%. Hardly

an excessive assumption; 10-year Treasuries yielded 6.44% on average

during 1996, at the beginning of the Fed’s money bubble, in which year

inflation was 3.4%.

More extreme moves are certainly possible. In 1990, 10-year Treasuries

yielded an average of 8.55%, while inflation in that year was 6.3%. A rise

in the yield curve to an 8.55% 10-year Treasury yield would cost investors

$5.06 trillion, almost double the credit losses from subprime and its

brethren. Should we revert fully to the days when Paul Volcker was Fed

Chairman and get the 13.92% 10-year Treasury yield of 1981, a year in

which inflation was 8.9%, the cost to investors from the interest rate

rise alone (we can assume a few additional bankruptcies, I think) would by

$9.33 trillion, about two thirds of the current value of common stocks

outstanding and more than three times expected credit losses.

One can debate the probability of the various outcomes above. Inflation is

already around 5% and is unlikely to drop much, so the 1996 estimate for

the peak 10-year Treasury yield would seem low. On the other hand, while

inflation could well reach 8.9%, it seems unlikely that we will need to

push Treasury yields quite up to 1981’s Volckerian levels, at least not

within the next year. So the 1990 estimate is perhaps the best, involving

a loss to investors of around $5 trillion or a little over. Such a loss

will produce fewer calls for bailouts than the $3 trillion credit losses,

but just as much economic damage, albeit much of it unnoticed by the

general public.

Yields are at

historic low levels.

> Back to Bonds

> Back to top of the page

Goldonomic, Florida, USA -

+1

(772)-905-2491

+1

(772)-905-2491 |