30

May

2024

Weimar Investing

Fortunes to be made and Fortunes to be lost

In the USA the 1930 wealth destruction was lead by deflation: the dollar went up.

In the USA the 1930 wealth destruction was lead by deflation: the dollar went up.

In 2008/09 wealth destruction is lead by Weimar style inflation: the dollar will come down!

(There is a fundamental difference between the two cycles!)

The Weimar experience involved high unemployment and hyperinflation simultaneously. With the money supply growing at rates up to 35 % per annum and central banks floating the markets with billions of fresh money to keep the system alive, we are heading full steam to Hyperinflation like Germany experienced during the Weimar revolution, and Zimbabwe was living yesterday. (click here for the charts under CDO subprime)

In those days, printing money was somewhat limited as there was a shortage of paper and ink. Some countries, like Poland, were even forced to reduce the colors of the notes because ink got scarce and expensive. In Germany, burning the money became cheaper than buying wood or coal.

Today, Federal banks issue electronic money. The computer has become the limit. In other words, FIAT PAPER MONEY is about to become worthless, just like treasury certificates, T-bills, bonds, bank savings accounts, and other similar deposits. Their face value will surely remain the same, as will the nominal interest. However, this won't suffice to cover the galloping Inflation rate.

Real Estate will unfortunately not be able to escape either. It is rather easy to imagine that the Government will (as happened during the Weimar Revolution), under the pressure of the voting public, block all rents. As a result, the landlords will get squeezed between the rising costs of maintaining the property and the low rental income(s).

Investing is about to become a totally different exercise. To safeguard income and savings, people will massively start to exchange paper fiat money for REAL MONEY and other tangible assets (LOCG). As a result, not only will gold and silver rise, but I expect the same to happen for the stock markets and/or at least for certain parts of it. Pure logic as stocks are a participation in REAL ASSETS.

Investing is about to become a totally different exercise. To safeguard income and savings, people will massively start to exchange paper fiat money for REAL MONEY and other tangible assets (LOCG). As a result, not only will gold and silver rise, but I expect the same to happen for the stock markets and/or at least for certain parts of it. Pure logic as stocks are a participation in REAL ASSETS.

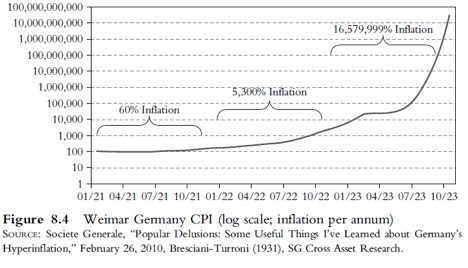

It is not, however, the case that the economy within Germany continued to decline throughout the whole period 1919 – 1923. In 1920 the currency stabilized for a period of some 6 months. *The mark actually gained in value against foreign currencies so that prices of imported goods (commodities) fell by some 50%. The price index remained almost constant, and the value of the German mark improved to approximately 1US$ to 69 German marks. It has been argued that the Weimar Government could have introduced a stable currency at this point. Instead, they continued to increase the amount of money in circulation – which is inflationary. The result was hyperinflation in 1923.

* This is EXACTLY the same we see today with the Dollar and the falling commodities.

* This is EXACTLY the same we see today with the Dollar and the falling commodities.

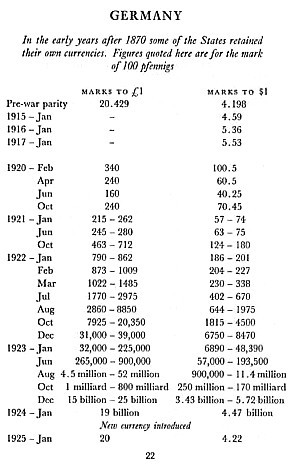

"By July 1922, the German Mark fell to 300 marks for $1; in November, it was at 9,000 to $1; by January 1923, it was at 49,000 to $1; by July 1923, it was at 1,100,000 to $1. It reached 2! 5 trillion marks to $1 in mid-November 1923, varying from city to city.

So the printing presses ran, and once they began to run, they were hard to stop. The price increases began to be dizzying. Menus in cafes could not be revised quickly enough. A student at Freiburg University ordered a cup of coffee at a cafe. The price on the menu was 5,000 Marks. He had two cups. When the bill came, it was for 14,000 Marks. "If you want to save money," he was told, "and you want two cups of coffee, you should order them both simultaneously.

"The presses of the Reichsbank could not keep up though they ran through the night. Individual cities and states began to issue their own money. Dr. Havenstein, the president of the Reichsbank, did not get his new suit.

A factory worker described payday every day at 11:00 a.m.: "At 11:00 in the morning, a siren sounded, and everybody gathered in the factory forecourt, where a five-ton lorry was drawn up loaded brimful with paper money. The chief cashier and his assistants climbed up on top. They read out names and just threw out bundles of notes. As soon as you had caught one, you dashed the nearest shop and bought just anything that was going."

Teachers paid at 10:00 a.m. and brought their money to the playground, where relatives took the bundles and hurried off with them. Banks closed at 11:00 a.m.; the harried clerks went on strike.

“The flight from a currency that had begun with buying diamonds, gold, country houses, and antiques now extended to minor and almost useless items -- bric-a-brac, soap, hairpins. The law-abiding country crumbled into petty thievery. Copper pipes and brass armatures weren't safe. Gasoline was siphoned from cars. People bought things they didn't need and used them to barter -- a pair of shoes for a shirt, some crockery for coffee.

Berlin had a "witches' Sabbath" atmosphere. Prostitutes of both sexes roamed the streets. Cocaine was a fashionable drug. The newly rich and their foreign friends could dance and spend money in the cabarets. Other reports noted that not all the young people had a bad time. Their parents had taught them to work and save, and that was clearly wrong, so they could spend money, enjoy themselves, and flout the old. The publisher, Leopold Ullstein, wrote: "People just didn't understand what was happening. All the economic theories they had been taught didn't provide for the phenomenon. There was a feeling of utter dependence on anonymous powers -- almost as primitive people believed in magic -- that somebody must be in the know and that this small group of 'somebody' must be a conspiracy. "When the 1,000-billion Mark note came out, few bothered to collect the change when they spent it.

By November 1923, the breakdown was complete with one dollar equal to one trillion Marks. The currency had lost meaning."

Over most of Germany, the lead was beginning to disappear overnight from roofs. Petrol was siphoned from the tanks of motor cars. Barter was already a usual form of exchange, but now commodities such as brass and fuel were becoming the currency of ordinary purchase and payment. A cinema seat costs a lump of coal. With a bottle of paraffin, one might buy a shirt; with that shirt, the potatoes needed by one's family. Herr von der Osten kept a girlfriend in the provincial Capital, for whose room in 1922 he had paid half a pound of butter a month: by the summer of 1923, it was costing him a whole pound. ‘The Middle Ages came back,' Erna von Pustau said.

Communities printed their own money, based on goods, on a certain amount of potatoes or rye. Shoe factories paid their workers in bonds for shoes they could exchange at the bakery for bread or the meat market.

Those with foreign currency, becoming easily the most acceptable paper medium, had the greatest scope for finding bargains. The power of the dollar, in particular, far exceeded its nominal exchange rate. Finding himself with a single dollar bill early in 1923, von der Osten got hold of six friends and went to Berlin one evening determined to blow the lot, but early the next morning, long after dinner and many nightclubs later, they still had change in their pockets. There were stories of Americans in the greatest difficulties in Berlin because no one had enough marks to change a five-dollar bill: of others who ran up accounts (to be paid off later in depreciated currency) on the strength of even bigger foreign notes which, after meals or services had been obtained, could not be changed; and of foreign students who bought up whole rows of houses out of their allowances.

There were stories of shoppers who found that thieves had stolen the baskets and suitcases in which they carried their money, leaving the money itself behind on the ground, and of life supported by selling every day or so a single tiny link from a long gold crucifix chain. There were stories (many of them, as the summer wore on and as exchange rates altered several times a day) of restaurant meals that cost more when the bills came than when they were ordered. A 5,000-mark cup of coffee would cost 8,000 marks by the time it was drunk.

© - All Rights Reserved - The report's contents may be copied, reproduced, or distributed with the explicit indication of the source: www.Goldonomic.com