Bond Fundamentals I

Update October 2023: Debt Destroys Nations

Once it passes the Rubicon from extreme to just plain madness, debt destroys nations. Just ask the former Spanish, British, or Dutch empires. Or ask the inter-war Germans. Ask the Yugoslavians of the 1990s, a historian of Ancient Rome, or a merchant in modern Argentina.

It’s all pretty much the same story, just different, a different stage or curtain call. Like Hemingway’s description of poverty, the process begins slowly at first and then all at once. Part of this process involves currency debasement needed to pay down more desperate issuance of IOUs, a process evidenced by rising rather than “transitory” inflation.

Thereafter comes increased social unrest and, hence, increased centralization from the political left or right in the name of “what’s best for us.”

Note: the Belgian debt is LARGER than the Greek debt!

Updated October 6, 2020 - Figures are getting worse and worse!

|

|

|

|

|

|

Updated December 17, 2018 - Debt = Money and Money = Debt

When Obama took office in 2009, the national debt was at just $6.3 trillion up from $3 trillion at the beginning of Bush’s tenure in 2001. Bush doubled the national debt in just 8 years. Obama is set to triple the national debt in less than 8 years. More than $7 trillion of additional US national debt will have been accumulated over the 8-year duration of Obama's two presidencies, which is more than the accumulated U.S. national debt of all previous U.S. presidents combined.

| The Total U.S. Debt to GDP ratio is now over 300%. Such debt levels ordinarily give rise to debt crises and currency crises. |

The U.S. debt position increasingly has all the hallmarks of a Ponzi scheme. One must add astronomical expenses of more than $200 trillion of U.S. government unfunded liabilities such as Medicare, Medicaid, and Social Security to this national debt. Household debt--including mortgages, credit cards, auto loans, and student loans -- remains close to $12 trillion. [click on the picture below]

The ability of the U.S. to service its debt will be drastically reduced if rates move higher. Already, a number of states have defaulted. The luxury of determining interest rates may not be one that the Fed will enjoy for very much longer. When rates do finally rise, we may witness the default of the U.S.

With the U.S. national debt surging another $1 trillion in recent months to over $18 trillion, it is difficult to see how interest rates can be raised in any meaningful way without creating an economic collapse. This is not to mention the huge levels of private debt at every level of American society and indeed, the unfunded liabilities of between $100 trillion and $200 trillion.

The Japanese have no option left...as of June 2013, it is 100% sure they will have to monetize their debt and end up with Hyperinflation...it's only a matter of time before the herd loses its faith in the system.

The point of no return has been passed...Interest rates will go up once MATHEMATICS of compounded interest decides the time has come (and compounded interest rates move exponentially or faster and faster). As I explained during an interview with James Turk in March 2010, the danger is coming out of a corner nobody expects it will be coming from or JAPAN. Over the past years, Japan's critical interest rate level has come down to 1 %. In Europe, it is 6% and falling. For Japan, however, even if interest rates continue to come down (and there is less than 0.5% room left), the mathematics of compounded interest has taken over: there is NO WAY OUT. Today it is only a matter of trying to find out WHEN the accident will happen. When it does, it will have wide international ramifications.

The point of no return has been passed...Interest rates will go up once MATHEMATICS of compounded interest decides the time has come (and compounded interest rates move exponentially or faster and faster). As I explained during an interview with James Turk in March 2010, the danger is coming out of a corner nobody expects it will be coming from or JAPAN. Over the past years, Japan's critical interest rate level has come down to 1 %. In Europe, it is 6% and falling. For Japan, however, even if interest rates continue to come down (and there is less than 0.5% room left), the mathematics of compounded interest has taken over: there is NO WAY OUT. Today it is only a matter of trying to find out WHEN the accident will happen. When it does, it will have wide international ramifications.

Japanese interest rates only have to rise to 2.8% in order to swallow 100% of the Tax revenues! On the chart to the left, Japanese interest rates (red line) have been coming down to almost zero while the amount of Outstanding Treasuries (candles) is going up exponentially. Recently, however, the Interest Payments (blue line) have risen...even at a time when Interest rates are coming down. Total outstanding Treasuries are rising exponentially, and Japan is now issuing even more Bonds/Treasuries...This is accelerating and getting out of control no matter what they do. By issuing more Bonds, they brought forward their day of reckoning. Japanese interest rates only have to rise to 2.8% in order to swallow 100% of the Tax revenues ! that is, if no debt is added to the existing. And this is exactly what they are NOT doing. This is the prelude to Hyperinflation in Japan...

There are very few options to deal with the overwhelming debt burden in most countries: raise taxes, cut spending, increase growth, or print money. Guess which one is more likely? Inflation from currency dilution is baked in the cake and will spur further gold demand and light a fire under the price.

| 10-Year U.S. Treasury Note Rate: A Historic bottom | Federal Government Debt as a % of Gross Domestic Product |

|

|

Public debt to Gross Domestic Product - The Debt is the problem, not the economy. Once the public debt is 100% or more of GDP, there is a VERY SERIOUS problem.

Lowering debt to 180% of GDP has become extremely difficult, and in some cases (Ireland), there are simply not enough available savings.

This is how fast long term interest rates rise in Italy, Spain, and Portugal. Rising long term interest rates are the prelude to a default of Greece, Portugal, and Spain...BEFORE these countries do, they will have to leave the EURO. [charts for June 2012]. As long as the EU-member country is part of the EU-zone the ECB will continue to control the interest rates

| Italy 10 y Gov. bond yield | Spain 10 y Gov. bond yield | Portugal 10 y Gov. bond yield | Belgium 5 y Gov.bond yield |

|

|

|

|

| 2018 figures - click to enlarge | |||

Falling income (taxes) and rising expenditures leave the Authorities no other choice but to print money (QE) and make it "impossible" to mop up the money. Mopping up the excess of Money once it has been issued is as difficult as putting back toothpaste into the tube after your child has pushed it out...

| Taxes versus Outlays in the USA - 2018 |

Taxes versus Outlays in Britain | France is an accident waiting to happen | International Debt as a % of GDP | European public debt as a percentage of GDP -2018 |

|

|

|

|

|

| Click here for Debt Clock-EU | ||||

| USA Per Capita debt Feb 2012 | USA debt to GDP ratio | Skyrocketing debt | Feb 2015 - Greece 5 y | Nominal Public debt per citizen EU-2018 |

|

|

|

|

|

| click to enlarge | ||||

This is how the basic mechanism for Bonds works - [This example doesn't take into account the yield to maturity] - Yield to maturity

Assume you sign in or buy a Bond/Treasury yielding 3% maturing in 2020 (10 years) at 100 (nominal value) and the redemption price also is 100%.

* You invest $ 10,000 x 100% = $10,000 . Each year you will receive $ 300 interest.

- If interest rates stay constant for the next 10 years, the market value of a Bond ABC 3% 2020 will remain the same or 100% and the nominal value paid back to the bondholder in 2020.

- If however, interest rates rise to 6%, the market value of the 3 % ABC Bond will fall until it also yields 6% or by 50%.

- Each buyer of the new issued 6% XYZ bond pays $ 10,000 x 100% = $ 10,000 and receives 6% or $ 600 interest per year.

- For this to happen to the 3% ABC Bond the price has to fall until each new buyer of this 3% bond also receives $600 interest per year. Hence the price of our 3% ABC bond has to fall by 50%, allowing each new investor to buy $10,000 x 50% x 2 = Nominal $ 20,000 bonds maturing in 2020 and paying 3 %. [$20,000 of our 3% ABC bond now also pays out $600 per year].

- If interest rates continue to rise like is now happening in Greece (12%), your loss becomes a lot higher. Assuming the interest rates rise from 3% to 12 %, the 3% ABC Bond price has now to fall until it also yields 12%. For this to happen the price has to come down to 25 %. Our 1st investor (3% bond ABC maturing in 2020) now loses 75% of his capital. At 25% each new investor can again buy the same yearly yield of $ 1200. In this case, he will buy a nominal amount which is four times higher: $ 40,000 nominal of Bond ABC @ 3% x 25% equals a $ 10,000 investment at 3% which yields $ 1200.

Conclusion:

- Because interest rates in Greece have risen to 12% in just over one year, the Bondholder has lost 75% of his savings which he eventually may recover in 2020 IF there is no DEBT MORATORIUM between today and 2020 (something which is highly probable). If we have a debt moratorium the Greek (or other bonds) bonds will be rolled over for at least another 100 years and more at the same low 3% interest rate

- Assuming there is no debt moratorium (best case scenario, we'll have a runaway and/or high inflation rate of more than 10%. In this case, the loss will be: 10% - 3% per year on the interest (-7%) and an additional 10% per year on the capital...in other words, not even peanuts will be left in 2020

note:

1. This is a simple calculation method. Yield to maturity is different and slightly better than what we show in our example but not taken into account as it is too difficult to explain and understand. IF we have no debt moratorium the value of our 3% ABC bond will go up by about 7.5% each year it is closing in 2020.

2. Bonds with an adjustable rate or insured nominal rate are most of the time insured by some dangerous uncontrolled Derivatives (Credit Default Swap).

3. To calculate the yield to maturity one must make the difference between the market and redemption price, divide it by the number of yours until maturity and add or subtract this figure from the calculated yield.

Japan is never mentioned...but their situation is bad, bad, bad

For Japan the critical interest rate level is 1 %: once interest rates for Treasuries break the 1% level, Japanese debt will start to grow exponentially.

The manipulation of Bonds and interest rates will continue until the system falls apart.

-

"This is still a bumpy road," said David Schnautz, a fixed-income strategist at Commerzbank AG in London. "This kind of news is highly market-moving and any relief we see in terms of spreads tightening is vulnerable."

-

The yield on Portugal's 10-year bond increased 24 basis points, the most since Sept. 20, based on closing prices, to5.93 percent as of 3:39 p.m. in London. That left the extra yield, or spread, investors demand to hold the bonds instead of similar German bunds at 328 basis points.

-

Greece's 10-year yield rose 79 basis points, the most since June 15. The spread with bunds widened to 779 basis points, the most since Oct. 1. Ireland's 10-year bonds yielded 408 basis points more than similar bunds, up from 393 yesterday.

-

Portugal's government and the opposition Social Democrats broke off talks on the 2011 budget proposal, which include plans for the deepest cuts since at least the 1970s. There's "no possibility of continuing" negotiations, Eduardo Catroga, a former finance minister who represented the rival party in the discussions, said in Lisbon today. Prime Minister Jose Socrates, lacking a parliamentary majority, needs the largest opposition party to back the budget or abstain for it to be passed. The Social Democrats have opposed tax increases and called for deeper spending cuts. Portugal sold 611 million euros ($843 million) of bonds due in 2014 today, attracting bids equivalent to 2.8 times the amount offered, down from 3.5 times in September.

The way Government debt exploded over the last 10 years and the interest rates were pushed down at the same time, is nothing more but a big HOLDUP of the savers. Already in 2001, we started to advise our friends to get into Gold (and out of fiat paper money and bonds).

Click on charts to enlarge

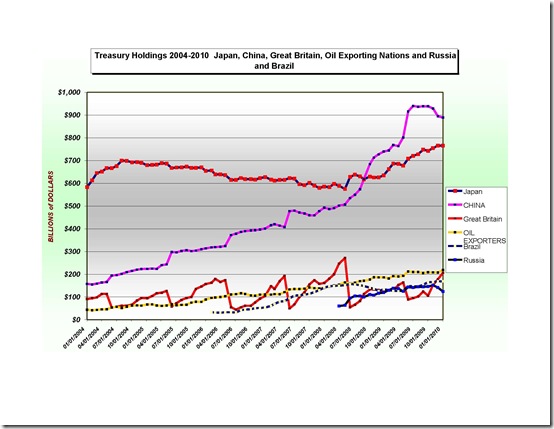

US Treasury holdings Japan, China, Great Britain, OPEC, Russia, and Brazil [interesting is that the Treasury holdings of Britain (a country which is virtually bankrupt) has been going up whilst the holdings of China came down and Japan was flat.]

Bonds, Gilts and Treasuries are nothing more but an option to buy worthless fiat paper money.

Within the next 12 months, the U.S. Treasury will have to refinance $2 trillion in short-term debt. And that's not counting any additional deficit spending, which is estimated to be around $1.5 trillion. Put the two numbers together. Then ask yourself, how in the world can the Treasury borrow $3.5 trillion in only one year? That's an amount equal to nearly 30% of our entire GDP. And we're the world's biggest economy. Where will the money come from?

The government is growing the very Monster who will destroy itself in the near future.

No Government has ever paid off its debt. The government by increasing its debt consumes all productivity of the country. In order to keep things going, it wages a war against its own manufacturing system and citizens by increasing Taxation, Regulation, and Inflation. As Capital is leaving the country they even go after Capital which is being hidden in countries like Switzerland and other Tax Heavens.

But as long as the domestic situation doesn’t improve Capital continues to leave the country and so further reduces the economic growth. This leaves the Government with a greater deficit and even more, must be borrowed and more taxes must be voted into place (Green Taxation is better digested). It now has become a vicious circle. This pattern will continue until the system collapses as the USSR and China did in 1989 and Zimbabwe beginning of 2009. As the system collapses it takes no prisoners and ‘all bondholders’ loose their savings. Bonds and Fiat Paper money being the same ‘Assignats’ the latter also loses its value and we have hyperinflation until it is replaced by another instrument which is accepted by the market and a fresh cycle starts….

In the past not only did we see Bonds lose their value because of Hyperinflation (Weimar, Zimbabwe) but in the end and even if we did not have a cycle of Hyperinflation, the Government repudiated on their debt or debt was erased like it was in Zimbabwe beginning of this year. Such even happened with Gold edged (Gold guaranteed) bonds issued by the USSR and China decennia ago.

Today it is simply not safe to keep your savings in Bonds. Not only do they pay a negative yield because the Real Interest Rate is lower than the Inflation rate but Bonds are also (because of manipulation by the Central Banks/Authorities who are keeping interest rates artificially low) extremely expensive.

Similar conditions apply to Bank deposits and Savings accounts and to any Fiat Paper Money kept under your mattress.

Even worse is that similar conditions apply for Life Insurance companies, Insurance companies, and Pension Funds as these are legally obliged to invest the largest part of their reserves in (Government) Bonds. Not only will the number of retirees increase dramatically as Baby Boomers become inactive but the means to receive decent retirement payments are being eaten away by the REAL situation or Negative Real Interest Rates and Real Inflation.

To be a safe one, in fact, must keep his wealth in REAL ASSETS: commodities, Equities, Real Estate, Gold and Silver (see our investment roster) and anything which is not Paper Money, Paper bonds or guaranteed by these.

Updated October 27, 2009

-

2009 Government Bond auctions are failing all over the Western world. German bond auction failed in a warning for governments to raise a record amount of debt to stimulate the economy [January 7, 2009] and Britain suffered its 1st failed Gilt (government bond) auction since 2002 [March 25, 2009]. In the USA the Fed is done the same and plans to monetize $ 1050 billion by buying Treasuries and Mortgage bonds.

-

Watch the parabolic runaway on the P&F chart...January 20 the bond bubble has busted. Bonds will fall back to where this uptrend started in the first place. It only may take some time as the authorities have opted for Quantitative Easing and are printing the money they use to buy the bonds with. As a direct consequence, the Bond markets won't be affected by the huge demand of the Authorities for funds. Additionally, many mortgage owners see the finance cost of their homes lowered. This should take some steam off the Real Estate markets. The rise of interest rates is delayed, but for how long? Expect sooner or later the hyperinflation will push them up strongly.

-

Bonds are a loose-loose situation. Bonds ain't better than fiat paper money. Basically, both are equally DANGEROUS government debt. In the 1920's-30's most European countries held a moratorium on their debt hereby chasing huge quantities of capital to the US. President Roosevelt had no other option left but to call in Gold and devaluate the Dollar by 40%. Bonds are either the subject of a moratorium or their value is inflated away.

-

Who in their right mind would flee to bonds when the Fed is in the process of bailing out Wall Street? Does nobody remember what happens over and over again with Government debt? Buffet is 100% OUT of US treasuries. He knows what is coming. We know it too!

-

In an ultimate Japanese style effort to keep the economy alive: 30-year yields are still at historic low levels. Today these are so low that after commission the nominal Yield has become negative. Add the real inflation rate of 12% and the loss becomes a dramatic 10% y/y! One has to be crazy to buy some...

-

Bonds are a loss-loss situation. In a hyperinflation, the financial markets break down and bonds become worthless. In case of a deflation, the Authorities repudiate their debt by a Moratorium.

-

2008 there is a huge quantity of government debt building up in the pipeline, and the government bonds due to be issued in the fourth quarter and early next year will only add to the problems some countries are facing, and particularly those countries like Greece and Italy who already carrying large amounts of debt that needs to be refinanced or rolled over. It has been estimated that European government bond issuance will rise to record levels of more than €1,000bn in 2009 (30 percent higher than 2008)! 2009 it has become clear that ALL GOVERNMENTS will use Quantitative Easing = Print money to finance their deficits.

-

Quantitative Easing = monetization of DEBT or the Authorities are PRINTING money to pay the bills.

-

30 Year Bonds will tell us when the Hyperinflation takes off. The important level is 4.3%, right, where we are NOW. Break it and kiss the Bonds good-bye.

-

Interest rate cycles last on average 25/27 years. Last time the interest rates bottomed was in 1981. Add 27 and you have 2008 or exactly the last top of the Bond market. Once the Bond market wakes up, it will be Game over. Important levels are 3,40% for 10-year yields and 4.30% for 30-year yields.

-

Interesting is that once again the British Gilt market (treasuries in the UK used to be gold guaranteed in the old days...and this gave them the name GILT) is a precursor of what is happening in the USA and also in the EU.

The world is going to need to find $5 trillion to finance government debt issuance. Additionally, we need to fund private business (Corporate debt) and consumer debt. Where is all this money going to come from?

June 8, 2009

The soaring bond yields and mortgage rates will wreak havoc on the debt-imbued economy. Already we saw a report by the Mortgage Bankers Association showing a drop of 16% in the Refinance and Purchase Index for the week ending May 29th. For an economy that has a total debt to GDP ratio of 370%, we can also expect dire repercussions in everything from credit card loans to municipal bonds.

Authorities can only control (manipulate) interest rates so long...In the long run, the market forces always kick in.

Updated January 22, 2009

In an economy saddled with fractional reserve banking, commercial banks are guaranteed by a central bank willing to buy any debt securities and to provide other loans at below-market interest rates (with money the central bank creates out of nothing) the market restraints are replaced by opposite forces.

For most of the investors, it creates a false signal which encourages the malinvestments of capital. In other words, at some point, they discover (the real estate sector) that the production of their increased goods can only be sold at distressed prices and that this forces them into bankruptcy (examples: the builders, financial institutions that provided the mortgages)…

Worse is that artificially low-interest rates discourage savings and encourage borrowing on the part of the public and encourage consumption. This is exactly the opposite of what should happen in a sound economic system.

Massive borrowing makes credit less available to already overextended consumers. By the time the buildings (real estate) and capital equipment (China, India) are completed, the consumer has run out of steam. Inventories pile up. Production is cut back. Capital good (HOCG) orders are canceled. Factories are closed and people laid off. Consumer demand falls even more. Everyone has liquidity problems. The credit boom has become a depression.

The depression also reduces the tax revenues of government at a time where government expenditures (unemployment compensation) increase. In other words, the government deficit grows mightily at the very time where consumers and industry are squeezed financially. Because of a hike in demand for money and credit, interest rates soar in a cycle of hyperinflation and Bonds and fiat money become worthless.

January 9, 2009 - German bond sale’s fate signals trouble ahead

By David Oakley in London

Published: January 7 2009 13:30 | Last updated: January 7 2009 20:45

A German sovereign bond auction failed on Wednesday as investors shunned one of the most liquid and safe assets in the world in a warning for governments seeking to raise record amounts of debt to stimulate slowing economies.

The fate of the first Eurozone bond auction of 2009 signals trouble ahead as governments around the world hopes to issue an estimated $3,000bn in debt this year, three times more than in 2008.

December 19, 2008

American bankers are so fearful of a replay of the 1930's Great Depression, they've finally reached the point of "No-return," - lending $30-billion to Uncle Sam at a rock-bottom interest rate of zero percent. Demand was so great at the last auction; the Treasury could have sold four times as many T-bills. If short-term T-bill rates go negative, frightened bankers would effectively be paying the US Treasury. for the privilege of lending money to it!

The last time short-term T-bill rates went negative was during the Great Depression when frightened bankers were effectively paying the US Treasury for the privilege of lending money to it!

There are a number of reasons why Treasury bond yields and the yield curve, in general, are likely to rise sharply in the USA in 2009:

· Borrowing requirements. Treasury borrowed over $1 trillion in the year to September 2008; it is expected to borrow close to $2 trillion in the year to September 2009. That’s 13% of US Gross Domestic Product. Not all of this is deficit; about $500 billion is refinancing and another $500 billion is for bailout schemes, some of which the US taxpayer may eventually see back. Still, in terms of GDP, that’s far more debt than the US capital market has ever been asked to absorb, other than during World War II. At some point, “crowding out” must occur; we certainly cannot assume that Asian central banks will want to take the entire load, at interest rates less than zero in real terms.

· Inflation. The Fed appears to believe that the current recession will bail the United States out of its inflation problem. The example is given of Japan in the late 1990s, after which the Fed explains that they will avoid the mistakes of the Bank of Japan, thus preventing damaging deflation. Actually, that seems to be wrong on two counts. The main mistake in 1990s Japan was not monetary but fiscal; government spending was allowed to expand inexorably, producing ever larger and larger deficits. That mistake appears to be only too likely to be repeated here. The difference is that the United States currently has a 1% Federal Funds rate and 5% inflation, the approximate opposite of Japan in the early years of its slump. With M2 money supply (the one the Fed will divulge) up at an annual rate of 18.3% since the beginning of September, it seems likely that inflation will accelerate – as it did in the recessions of 1973-74 and 1979-80.

Rising real rates of return. The yields on Treasury Inflation Protected Securities have already risen from just over 1% to nearly 3% since the beginning of 2008. Given the excess of bonds coming to the market, it makes sense that real yields should rise. That in itself suggests that conventional Treasury bonds are hopelessly overvalued – with the 10-year TIPS yielding 2.82% and the 10 years Treasury 3.78%, the implied rate of US inflation over the decade to 2018 is 0.96% per annum, for a total rise in prices by 2018 of less than 10%. If you think that’s likely, I can get you a deal on Brooklyn Bridge!

Thus Treasury bond and other prime bond yields can be expected to rise sharply in 2009. This will cause losses to their holders. To the extent that such holders are foreign central banks, the United States probably doesn’t need to worry. Foreign central banks have been gentlemanly holders of US debt through periods such as 2002-08 when the dollar has depreciated; a rise in interest rates simply gives them another way of making a loss. Personally if I were the Chairman of the People’s Bank of China and Treasuries had lost me the kind of money they have in the last five years I’d probably declare war on the US, but fortunately, central bankers are a phlegmatic and tolerant lot!

However domestic holders are a more serious problem. To the extent that pension funds have losses on their holdings of bonds, they will need to raise contributions; to the extent that insurance companies have such losses, they will need to raise premiums. Some entities will be hedged, but by doing so they will have simply transferred the interest rate risk to somebody else; by definition of derivatives the total outstanding derivatives position must be zero, however large the individual positions taken.

Assuming the $30 trillion state, mortgage and private corporate debt outstanding has an average duration of 5 years, a fairly conservative assumption, and neither the shape of the yield curve nor the premiums payable for risk alter significantly by the end of 2009, a 1% rise to 4.74% in Treasury bond rates by December 2009 would cause a total loss to investors in the $30 trillion of Federal, agency, mortgage and prime corporate debt of 3.9% of the debt’s principal amount, or $1.17 trillion. Not as bad as the credit losses.

However, once rates start rising, they are likely to rise much more than 1%. To cause a loss of $3 trillion, the same as the estimated credit losses, 10 year Treasury bond yields would have to rise to 6.43%. Hardly an excessive assumption; 10-year Treasuries yielded 6.44% on average during 1996, at the beginning of the Fed’s money bubble, in which year inflation was 3.4%.

More extreme moves are certainly possible. In 1990, 10-year Treasuries yielded an average of 8.55%, while inflation in that year was 6.3%. A rise in the yield curve to an 8.55% 10-year Treasury yield would cost investors $5.06 trillion, almost double the credit losses from subprime and its brethren. Should we revert fully to the days when Paul Volcker was Fed Chairman and get the 13.92% 10-year Treasury yield of 1981, a year in which inflation was 8.9%, the cost to investors from the interest rate rise alone (we can assume a few additional bankruptcies, I think) would by $9.33 trillion, about two thirds of the current value of common stocks outstanding and more than three times expected credit losses.

One can debate the probability of the various outcomes above. Inflation is already around 5% and is unlikely to drop much, so the 1996 estimate for the peak 10-year Treasury yield would seem low. On the other hand, while inflation could well reach 8.9%, it seems unlikely that we will need to push Treasury yields quite up to 1981’s Volckerian levels, at least not within the next year. So the 1990 estimate is perhaps the best, involving a loss to investors of around $5 trillion or a little over. Such a loss will produce fewer calls for bailouts than the $3 trillion credit losses, but just as much economic damage, albeit much of it unnoticed by the general public.

Yields are at historic low levels.

Copyright 2017, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic