Corporate Bonds

July 9, 2024 - It LOOKS LIKE WE HAVE A MATURE TOP + Down Trend!

In November 2018, the Bank for International Settlements (BIS) published a study of “zombie” businesses. Looking at the 32,000 publicly traded companies in 14 advanced economies, they found that 12% were both:

In November 2018, the Bank for International Settlements (BIS) published a study of “zombie” businesses. Looking at the 32,000 publicly traded companies in 14 advanced economies, they found that 12% were both:

- At least ten years old and still in business despite their inability to make any money.

- Had an interest coverage ratio below 1.0 for three consecutive years. In other words, these companies weren’t making enough revenue to pay back their loans, much less cover their other expenses and earn a profit.

"This is Misallocation of funds: Do you really think this is NORMAL: Corporations borrow money at 0% to buy their own shares!?"

Corporation Bonds are better than Treasuries because they are guanranteed by REAL ASSETS.

Treasuries are guaranteed by NOTHING and Governments NEVER pay back debts.

Real Danger always comes out of a corner; nobody expects it to come. The odds that the Great Depression will get fired up by the corporate sector and infect the financial sector and the banks are incredibly significant. If we’re lucky, it will occur gradually. Still, more likely, given high leverage and interconnected markets, it will happen fast...extremely fast, so fast that it will be very hard, if possible, to adapt.

This chart tells it all...over the next four years, a loss of 50% to 70% is certainly plausible.

Junk Bonds -The Achilles of the Financial system - Also a Mature DOUBLE TOP FORMATION!

Note the 3 months Treasury Bill yields ZERO percent...just like during the Great Depression of the 1930s

Posted June 8, 2009 - Or how to buy Bonds for security and end up with 75-cent penny stocks!!

May 31 (Bloomberg) -- Most General Motors bondholders agreed to support a plan to exchange their debt for an ownership stake in the company as high as 25 percent, the New York Times reported, citing people familiar with the matter.

May 31 (Bloomberg) -- Most General Motors bondholders agreed to support a plan to exchange their debt for an ownership stake in the company as high as 25 percent, the New York Times reported, citing people familiar with the matter.

The paper said that investors holding a little more than 50 percent of GM’s $27.2 billion of debt agreed to the swap, removing the last roadblock for General Motors to file for bankruptcy protection tomorrow.

The paper said bondholders would initially get a 10 percent stake in the company, with warrants for an additional 15 percent. GM scheduled a news conference tomorrow in New York, where it’s expected to make its bankruptcy filing, the Times reported.

General Motors stock fell to 75 cents on May 29, below the $1 minimum usually needed to trade on the New York Stock Exchange and the lowest level in 76 years.

Updated May 12, 2009 - Corporate Bond Woes: Spreads And Fundamentals Anticipate The Most Severe High-Yield Default Wave on Record.

Currently, high-yield bond spreads anticipate a default rate of 21% in the U.S. Specifically, record bond spreads are not only due to fire sales but find some justification in the deterioration of credit quality down the rating scale. Similarly, the spike in the projected default rate is in line with the deterioration of credit quality of outstanding debt down the rating scale (Moody’s)

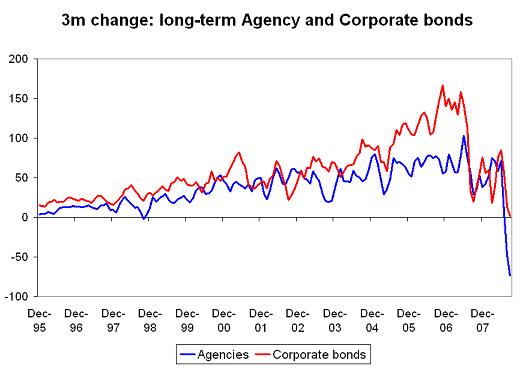

Corporate Bonds show a wholly different and negative image.

Credit Default Swaps could elevate any (low) rated corporate bond to a AAA level. One only had to buy insurance. Today's insurance premium price is increasingly becoming prohibitive, and Financial Institutions offering these Swaps (AIG) have disappeared.

Credit Default Swaps could elevate any (low) rated corporate bond to a AAA level. One only had to buy insurance. Today's insurance premium price is increasingly becoming prohibitive, and Financial Institutions offering these Swaps (AIG) have disappeared.

There is a vast discrepancy between the general price level of Government and Corporate bonds.

Copyright, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.