Inflation

Crash course: Inflation. (added September 2021)

Inflation Explained for dummies: inflation is a currency event and not an economic event

| Inflation is a currency event and not an economic event. Monetary inflation always leads to price inflation (higher prices). |

- Inflation results from a larger than proportionate growth in the money supply. The pain is higher prices and a weaker economy!

- Only constraining the influence of Politicians and Governments by a monetary constitution leads to lower inflation rates.

- Central banks, strongly independent from the Politicians, traditionally have much lower inflation rates.

- Inflation hurts POOR but also RICH people.

M3 and hyperinflation - hyperinflationary depression.

There is a great deal of debate about the root causes of hyperinflation. But Hyperinflation is often associated with economic depressions, wars (or aftermath), and political or social upheavals. Those who advocate Deflation because of a decreasing M3 don't understand what inflation and deflation are all about. The money supply (M3) is only one of three factors determining whether we have inflation or deflation. The other two are the velocity of money and the economy's real output. Due to its effects on the velocity of money, the ebb and flow of confidence have a much greater impact on the short-term trend of prices than changes in the money supply (M1-M2-M3-MZM).

economic depressions, wars (or aftermath), and political or social upheavals. Those who advocate Deflation because of a decreasing M3 don't understand what inflation and deflation are all about. The money supply (M3) is only one of three factors determining whether we have inflation or deflation. The other two are the velocity of money and the economy's real output. Due to its effects on the velocity of money, the ebb and flow of confidence have a much greater impact on the short-term trend of prices than changes in the money supply (M1-M2-M3-MZM).

We have entered the 2nd Phase of hyperinflation: a lack of money becomes evident in the second phase of the crisis - the financial crisis is replaced by an economic crisis, triggering massive bankruptcies that would spread globally in a chain reaction. During the second stage of the crisis, another large sum of capital will "evaporate" from the market...click here for more.

Authorities cannot maintain a (hyper) inflationary policy unless it is sugared with Deflation propaganda...like...why would we have hyperinflation when M3 is contracting? M3 is contracting because we have an economic depression! [By definition M3 must contract during the 2nd phase!]

| Authorities cannot maintain a (hyper) inflationary policy unless it is sugared with Deflation propaganda. |

During a cycle of (Hyper)-inflationary (re)depression, the price of High Order Capital Goods (like real estate) keeps falling whilst those of Low Order Consumer Goods rise strongly.

But Hyperinflation is a monetary phenomenon, not an economic one...and M3 is contracting because of the depression. This is normal and happens each time the economy moves toward hyperinflation.

Hyperinflation starts when the public is unwilling to hold the money for more than the time it is needed to trade it for something tangible to avoid further loss. A good indicator that Hyperinflation has started will be a sudden increase in the Velocity of Money. [ P = M x V ]. This alone can increase the general level of prices. Even with a falling M3!

Hyperinflation is a psychological phenomenon. It happens overnight, and it is complicated to forecast when it will start.

The main cause of Hyperinflation is a massive and rapid increase in the amount of money that is not supported by a corresponding growth in the output of goods and services. Assuming there is a decrease in the output of goods and services (like we have now), it is still possible to see Hyperinflation when the Output is falling faster than M3 is contracting. We have a recession/depression (output of goods and services is falling), and Public debt is soaring towards 100% of GDP (gross domestic product) and has, in some cases, even become larger.

We are about to enter the 3rd Phase of Hyperinflation: hyperinflation mostly starts when the Bond (Treasuries) market breaks down. It does when Authorities start to monetize their debt like they are doing now. UNDERCOVER (The ECB and the FED are already buying Treasuries/Bonds - Is it not weird that Spain sold all Bonds in about a day's time after a downgrade warning?) the public is unwilling to absorb it (the confidence is eroding). Who would be so stupid to buy 30-year Treasuries yielding a nominal 4% when real inflation takes both the Interest and Capital away?

Few realize the Quantity of Money is still dramatically up in the long run ...click here for more [charts for the Euro and the British Pound money supply are similar]. Looking at the chart below, one can clearly understand there is NO WAY to mop up this excess of the Money supply. It is simply too large. Having said this, the Authorities have absolutely no intention or will to mop it up. Inflation and Hyperinflation will simply erase the excess of Government debt, which is precisely what there are going for.

A hyperinflationary Depression we shall have!

For those that believe all depressions begin with deflation, I suggest reading a good history book and/or anything on hyper-inflationary depressions. They are not incompatible as many think. History is littered with examples of hyperinflationary depressions. They are all currency-related events.

Updated October 2017

consumer price inflation - corrected REAL Figures through September 2017

Note the inflation growth is still + 7% to + 8% higher than the official figure used by the Authorities. Inflation figures are important because they hugely impact other economic statistics. GNP (gross national product is a good example).

Politicians and Banks call "Printing Money" - Quantitative Easing!

Click here for the video clip.

- Today the quantity of freshly created Fiat Money is still larger than the money contraction due to the Credit Crunch. Hence, there is still monetary inflation and NOT deflation, as Talking heads incorrectly claim.

- Quantitative Easing is so widespread that it has reached a point where mopping it up becomes impossible.

- Also, we still have monetary Inflation of Low Order Consumer Goods (LOCG) and a price contraction [some call it price deflation] of High Order Capital Goods (HOCG).

The danger of hyperinflation lies in a dramatic increase in the velocity of money due to a loss of confidence, not in changes in the money supply.

Price = Money supply x Velocity |

“Yes, there is debt deflation, and the overall money supply is shrinking as a result. However, those calling for a "multi-year bull market" for the US dollar are insane. These individuals need to review basic monetary theory. The money supply is only one of three factors determining whether prices rise or fall. The other two are the changes in the velocity of money and the economy's real output.

As long as M3 (total money supply) keeps on growing at a rate higher than the economy's growth rate, it creates Inflation.

Inflation results from a larger than proportionate growth in the money supply. We see now that M3 (total money supply) is coming down as banks keep sitting on cash because they are reluctant to grant credit. The money supply is coming down but keeps on growing at a slower rate. Hence we still have Inflation, and NOT Deflation, as some talking heads incorrectly claim.

Only the RATE of Growth in Money supply is coming down; M3 keeps on GROWING at a slower pace (10% instead of 18%), and therefore we keep on having monetary inflation and not deflation. M1 is growing faster (more people are keeping their savings under their mattresses), and the rate of growth of M2 has also increased to almost 8%.

At this time, we also see the velocity of Money coming down. This is a normal and expected faze of the inflation/hyperinflation cycle we are living: people are spending less because they erroneously think prices will come down. The day they understand Inflation is here to stay, people will start to buy whatever they can to get rid of paper money. Velocity will pick up again, and we will, at that point, have entered Hyperinflation.

GDP (gross domestic product) is falling by almost 4%! According to the chart below, we are stuck in a depression since 2008.

inflation in disguise - by the time the chart below shows the spike, the entire event will be over...

Governments try to disguise the true rate of inflation through a variety of techniques:

-

- Outright lying in official statistics such as money supply, inflation, or reserves.

- Suppression of publication of money supply statistics or inflation indices.

- Price and wage controls.

- Forced savings schemes are designed to suck up excess liquidity. These savings schemes may be described as pensions, emergencies, war, or similar.

- Adjusting the components of the Consumer price index to remove those items whose prices are rising the fastest.

Velocity is a good indicator of Inflation and Hyperinflation. At first, velocity comes down as people start to spend less. This is what we have NOW. Only once they understand Inflation is to stay, velocity picks up as they scramble to get out of paper money and into Real Assets. This action is connected to Gresham's law: "Bad money drives the good money out of circulation." A modern example of this is Zimbabwe. Velocity, however, is a LAGGING INDICATOR...

Before 1933 was the Age of Gold. Back then, a dollar your grandfather saved in the early 1800s would buy the same amount of goods and services as a dollar you saved in the early 1900s! Can you imagine living in an environment where housing prices never skyrocketed, grocery prices were always constant, transportation and energy prices never rose, and where the value of money was as solid as the gold that fully backed it? Compared to today’s tragic environment, where the prices of life’s necessities relentlessly rise every year and impoverish millions, the Age of Gold was a financial paradise!

The money is already there...we just need more velocity to start Hyperinflation.

Inflation, the silent thief...it won't make any difference whether you have your money in a bank or under your mattress...it will be taken away where ever it is. Got REAL MONEY or GOLD!?

"Both the ECB and the FED keep the key interest rates at almost ZERO. At the same time, the central banks inject billions into the system. They call it Quantitative Easing sold packed with a propaganda ribbon of deflation. People know the Deflation propaganda is false. However, it keeps coloring the investment behavior of the Herd. And this is exactly what the Central Banks are after.

In the EU, the Tax level has reached the maximum level. It is so high it chokes the economy. Over the last couple of years, to fill the gaps, other tax inventions were voted into place: garbage bags, highway stickers, speed fines, you name it, and they have it. Belgium is now planning to increase the Diesel tax, and the Wealth-tax is being prepared.

The next step is inflation and hyperinflation. The chart below shows hyperinflation already sits in the pipe.

Our initial FIGURES FOR THE MONETARY BASE were $ BN 950!

Updated July 16, 2013

- It is impossible for Fiat Paper Money to increase in value if 20 % of it is created each year!

- It is a fallacy to measure Inflation by measuring (the consequences) price increases!

- It is incorrect to state that higher interest rates will bring down inflation!

"By a continuing process of inflation, the government can confiscate, secretly and unobserved, an important part of the wealth of their citizens." (John Maynard Keynes, chief architect of the modern-day economic system).

At no time has the world's biggest money been as MISALLOCATED and invested as it is today. They are generally run by misinformed, poorly prepared ignoramuses who are at the top of the world investment and banking industries. They have not studied (monetary) history or know economics and are repeating it as is always the case. THIS IS THE BIGGEST OPPORTUNITY IN HISTORY. The greatest transfer of wealth from those who store their wealth in paper to those that don’t is unfolding. ALL Markets will have to price in reality, and the reality is that the G20 in general and the financial and banking industries in particular (there are exceptions to this) are INSOLVENT. Rather than default through the normal process, they will default through the printing press, as legendary economist ADAM SMITH and Ludvig Von Mises have illustrated and predicted in their bodies of work. (Ty Andros)

Monetary inflation causes price inflation regardless of business conditions. This CONSEQUENCE is UNAVOIDABLE. We are in the midst of an unprecedented expansion of liquidity. As a result, we will experience unprecedented levels of inflation. There is no way to avoid the HYPER-INFLATIONARY CONSEQUENCE!

The definitions of Inflation and Deflation are tough to understand and are, most of the time, explained incorrectly:

- Inflation is not an increase in the price level of goods and services. It is a more than proportionate growth of credit and money supply. The consequence of this growth is mostly, but not necessarily, an increase in the price level of goods and services.

- Deflation is not a decrease in the price level of goods and services. It is a reduction of credit and money supply. The consequence of this action is mostly, but not necessarily, a fall in the general price level of goods and services.

The curse of deflation is that it increases the burden of debts. Incomes fall: debts stay the same. This way lies suffocation.

Also, in a cycle of (hyper)inflation, we see a shift from HOCG to LOCG. In other words, because of the misallocation of funds into HOCG, the supply of these goods is too large for the consumers to absorb. The general price level of these goods tends to fall. On the other hand, because of the same misallocation of funds, there is a shortage in the supply of LOCG, and the general price level of these goods goes up. The (hyper)inflation cycle will last until all of the misallocated funds have shifted from the HOCG into the LOCG, and the supply of these goods and the demand is in equilibrium. [note: HOCG or High Order Capital Goods - LOCG or Low Order Consumer Goods.]

This explains why the price of Real Estate (oversupply) is coming down, and at the same time, the price level of food commodities and energy is going up. Because the price level of Real Estate (HOCG) is falling at the very time when the price level of Food Commodities and Energy is going up, many are incorrectly recognizing the initial phase of (Hyper)inflation.

One of the reasons we have so much inflation is that in the past decennial, the Central banks misinterpreted inflation figures that were coming down as a result of Globalization (i.e., the production of cheaper goods in China); they incorrectly continued to increase the Total Money supply.

Charts: click on the charts to enlarge! As the American authorities have stopped publishing the M3 figures...because they became too expensive (not a joke!)

The M3 chart in the middle has been made using calculated data.

Only a Recession and Depression can cleanse and correct the misallocation of funds of the last decennial. A recession has started + 6 months ago, and Governments and Bankers are lying like hell about it. It is clear the bubbles have stopped making anybody rich, and we have initiated a Hyperinflation cycle. People who have problems understanding the situation should book a holiday in Zimbabwe. It won’t take long to understand that Mugabe, Ben Bernanke, and Mario are one and the same and follow similar politics!

This first stage of the inflationary process may last for many years. While it lasts, many goods and services prices are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution that will finally result in a considerable rise in all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices will drop one day. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy (we are leaving this point of no return NOW!).

But then, finally, the masses wake up. They suddenly become aware that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a concise time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

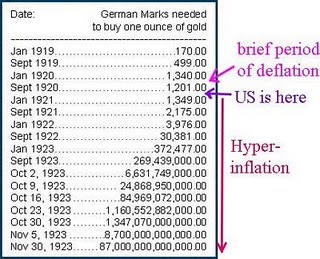

This happened with the Continental currency in America in 1781, the French mandats territoriaux in 1796, and the German mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last. (Ludwig Von Mises).

Hyperinflation, Recession, and Depression are real. Although it is at this point tough to forecast how much time politicians and Bankers will be able to buy and what the scenario will be, it is a fact that at this time, a Credit Crunch is unfolding. Economics and mass psychology are linked to each other. Therefore it is important for politicians and bankers to use propaganda and blame external factors like speculation and bubbles for price increases that result from the huge monetary growth.

“Credit expansion without an increase in savings that is at least equal to the newly created credit Banks extends from nothing, always does result in a crisis and economic recession.”

Note: In February 2008, the growth rate of M3 for the EU is 11,3 % (official figure published by the ECB). The USA has stopped publishing M3, but according to certain sources, it runs as high as 30 % per annum. Other sources publish a figure of +18 %.

Deflation propaganda is, together with the cooked inflation figures, a vital part of the inflationary policy of the Federal Banks.

In the current monetary system, the supply of money is not constant, and the central banks of this world are free to create as much inflation (money-supply growth and no gold reserve) as they want. There is a catch, though – the central banks can only do so if they can keep inflationary fears under check by constantly reminding the public of the threat of deflation. Turning over to the current situation, it should not come as a surprise then that in the past few weeks, the media has published various stories comparing the recent downturn in the US to the Japanese deflationary bust or the Great Depression of 1929.

In my opinion, as the economy is also psychology and sociology, this “deflation” propaganda is crucial to promote further the Federal Banks’ agenda of creating even more inflation as a “cure” for the ailing economy.

Let there be no doubt that the Federal Reserve is now desperately trying to inflate the system via rate cuts, pumping of liquidity, and bailouts. And it is this monetary inflation and not strong economic growth which is causing commodity and consumer prices to rise. A lot of these price increases are hitting the front pages of the Media: crude oil, agricultural and other commodities, etc..

Unfortunately, for the average citizen, this occurs when the economy is weakening, incomes are falling, and unemployment is rising. In other words, the Federal Banks’ inflationary efforts are making things a lot worse for most people.

The actual savings rate for the USA is negative. For Europe, it is declining to historically deficient levels. Trillions have been, are, and will be injected into the financial system to try to keep it liquid. But as the savings rate continues to come down under the pressure of disinflation, the situation becomes more critical each day.

Low or negative savings and over-indebted consumers. The personal savings rate in the US from 1950 to 2008 and total outstanding Consumer Credit from 1940 to 2008. There is no way to build a boom based on these figures.

Total debt in the United States is over $53 TRILLION dollars, which is almost 500% of net national income. We owe foreign entities 12.5 trillion, or 24% of the total. The situation in many European countries is not better.

Highway to hell: Ludwig von Mises stated: "There is no means of avoiding the final collapse of a boom brought about by credit (debt) expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit (debt) expansion, or later as a final and total catastrophe of the currency system involved."

The first alternative is deflation. The second is hyperinflation. Authorities have clearly opted for hyperinflation or more money supply.

The Fed can increase the money supply, but it cannot determine exactly how or where it will be used in the economy. We have a misallocation of funds. At this time, the misallocation is into Treasury bonds. Hence interest rates fall, and the value of debt rises. Businesses go bankrupt. We are witnessing this occurring at an alarming rate around the world. These are classic examples of Mal-investments gone astray.

Markets and asset prices have been distorted by excess credit and money creation. Global asset prices are mispriced, especially in the huge toxic wasteland of debt derivatives.

Soon it is discovered that the purchasing power of money is falling faster than the demand for money is rising. Money cannot be created fast enough to compensate for the loss of purchasing power. We are moving into Hyperinflation.

Interest rates start to rise, as do prices. The purchasing power of the currency falls despite higher interest rates. Slowly panic sets in. People can't spend their money fast enough - before it loses more purchasing power. The race to hell begins.

The fraud is seen for what it is. The currency is no longer accepted as the common medium of exchange. The use of the currency ends. The creature destroys itself by suicide - by hyperinflation. Hyperinflation is the death knell of paper fiat debt-money

Some examples of price increases (May 2008) - supply and demand also play a role) as a result of monetary inflation:

- Platinum has gone from 400.00 to 2,000.00, an increase of 400%

- Copper from 0.75 to 4.00, an increase of 470%

- Lead from 0.20c to 1.20, an increase of 500%

- Uranium from 0.63 to 63.00, an increase of 530%

- Crude oil from 12.00 to 124.00, an increase of 900%

- Molybdenum from 2.50 to 32.50, an increase of 1300%

- Rhodium from 400.00 to 9,400.00, an increase of 2200%

If you want to avoid inflation, high-interest rates, and volatile commodity prices, the first step is to avoid wars. The second step is to take the power of printing money out of the government's hands. Inflationary spirals occur during or immediately following major wars (WW I, WW II, Vietnam War, Iraq). Historically, peaks have occurred every 50 years.

The correct measure of inflation matters in many areas, not the least of which are social security payments and wage bargaining adjustments. Undoubtedly, an artificially low number favors government and corporations as opposed to ordinary citizens. But the number is also critical in estimating bond yields, stock prices, and commercial real estate cap rates.

Posted May 23, 2008

Pimco's Gross: Inflation Threat Is Being Underplayed

Pimco's Gross: Inflation Threat Is Being Underplayed

Americans are fooling themselves if they think U.S. inflation is under control, the manager of the world's largest bond fund said.

Bill Gross, a chief investment officer of Pacific Investment Management Co (PIMCO) said in his June investment outlook that he has been arguing for some time that inflation statistics "were not reflecting reality at the checkout counter."

He said statistical practices in calculating price growth had favored lower U.S. inflation over the last 25 years and called for change.

"Today's world, including its inflation rate, is changing. Being fooled sometimes is no sin, but being fooled all of the time is intolerable," Gross said.

"Join me in lobbying for change in U.S. leadership, the attitude of its citizenry, and (to the point of this Outlook) the market's assumption of low relative U.S. inflation compared to our global competitors."

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.