Buy Silver

Only buy "legal tender coins". Although we don't fancy collective mints, we offer our subscribers a wide variety at wholesale prices.

Buying Gold and silver is as simple as 1+1=2!

- Transfer the funds into a special account.

- Give or take 24 hours, buy your Gold and/or Silver.

- Decide where you want it shipped and/or in which Vault you want to store it in your personal name/box.

- Decide for which amount you want to ensure your holding. Note the insurance states that in case of theft, your gold is replaced with gold, not with CASH.

We offer 146 mint products, both gold and silver. Some are legal tender, some are collectibles, and some are for investment only. The prices range from approximately $19 to $ 2,900. All products are NEW and of PERFECT quality.

Some coins are legal tender, while others are not. The premiums of Collectives, however, range from 100% to 1000% over the spot. Large purchases ship free. Collective mints should NOT be bought as an investment. Be advised PREMIUMS on the price of Silver and/or Gold disappear once the price soars and that collective mints often sell at a discount during a buy climax. Of course, we also offer the traditional Gold and Silver Eagles, Maples, etc...

|

|

|

|

Regular gold & silver coins - low premiums |

|

Note:

- There are NO Sales Taxes or VAT on Silver and gold bought abroad.

- Buy gold and silver...don't try to get the lowest price...doesn't make sense at all...more important is to buy in the correct country and store it in the right vault.

Silver: Buy silver where you have NO Sales Tax!

Silver: Buy silver where you have NO Sales Tax!

It can be bought either in pellets, coins, or ingots. Silver is more cumbersome to store. Silver Maple leaves (1 oz.) are coined in Canada. Be warned certain countries charge exorbitant taxes (up to 21%) on the purchase of silver and silver coins. Shop around! Silver Eagles (1 oz.) are coined in the USA.

- In the Netherlands, Silver bars are taxed with 19% VAT.

- Silver coins are taxed either at 6% (valid for silver coins that were used as real money in the past) or 19%, and it is impossible to recuperate the VAT when you sell your Silver position. Try to buy GOOD DELIVERY bars. [Schone (gold and silver) and Argentia B.V. (only silver). Old Dutch silver coins are not taxed but contain only 72% pure silver. The balance is copper.

- In Belgium, there is Umicore (gold and silver). [Be aware that the Belgium tax man levies 21% VAT on Silver]. Other names are Argentor, Bosmans, and Goetz.

- In Germany, the VAT on Silver coins is 7%.

- In Switzerland, the VAT on Silver is 6%.

- In Canada, there is no sales tax on Silver.

|

As of today – with our assistance - you can buy and sell GOLD and SILVER and take delivery of the metal worldwide. Each shipment we do is insured door to door. In case of a sale, the funds can be transferred EVERYWHERE. We accept most Gold and Silver bars and coins. This is now also possible for SILVER. We let you buy silver in countries where there is NO Sales Tax and NO VAT whatsoever, After purchase, the metal is shipped to any place you instruct...and any shipment is fully insured from door to door. For storage, we now have a vault where you can ensure the stored goods for 100% of their value through Lloyds of London. Soon, we shall also have a vault where it will even be possible to ensure your metals against terrorism and war. [note: as a rule, the content of safety boxes in Banks is NEVER INSURED]. |

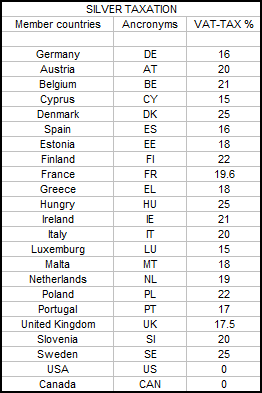

Taxation varies when you buy NEW silver coins.

(The table is indicative.)

If a Belgian citizen buys new Silver Eagles in the USA or new Silver Maple Leafs in Canada, he will only pay 6% on imports. [Expect the custom agent to levy the maximum duty and you to try to recover the balance]

In Switzerland, there is a 7.5% tax on any purchase but also 7.5% on any sale of Silver bars.

In the USA and Panama, there is NO TAX on Silver Eagles or Canadian Maples.

If you declare Silver coins on import in France, the French customs officers will charge the highest rate, and it will be up to you to claim the difference (and you are convinced the whole system is honest!!?...good luck).

Note that there is a difference in taxation of Silver bars, new Silver coins, and collection Silver coins. Silver is silver, and buys only Silver items with the lowest tax rate.

When you buy Silver coins or Silver bars, you ONLY pay for the Silver content. Assuming a Silver bar has a content of 99.9 (or 99.9%), you will only pay for the 99.9% of Silver.

Silver coins are sold at a premium above the Silver price because they are coins. Only buy those coins with the smallest premium.

Other good delivery bars (Gold and Silver) are Johnson Matthey, Metalor, Degussa, UBS, Scottsdale, and Engelhard.

Do you know it only costs $500 to store and insure 500 kg Silver for 100 %?

Specifications for Good Delivery Silver BarsThe physical settlement of a loco London silver trade is a bar conforming to these specifications: The gross weight of a bar should be expressed in troy ounces in multiples of 0.10, rounded down to the nearest 0.10 of a troy ounce. Marks on the Bars: - Serial number

|

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.