Gold Fundamentals

November 2023

"Soon, Gold will be used as Money again because people will stop trusting currencies!"

The gold price will likely explode due to the debt crisis and the impact of the negative "real" interest rates ruling in many major economies. Certainly, Central Bankers, Goldman Sachs, and JP Morgan failed after the manipulation. The day is close, it will, and from that day on, prices can double overnight!

Backwardation is a pricing phenomenon in the futures markets where the price of an asset now is higher relative to the price of that same asset in the future.

Updated September 2022 - Gold is Money! Everything else is BS.

Updated May 2022

|

|

Updated February 2021

|

|

|

|

Updated October 2020

Updated July 2019 -Why Gold is Money

Updated March 2019 -100 years Inflation adjusted Gold

Updated December 2018 - Gold production by top 5 gold miners is down 11%

This is how Gold is refined:

Updated May 2018

Updated February 2017

Quietly and without fanfare or mainstream media attention, liquidity is migrating to the physical Gold & Silver exchanges away from London and the USA. The fiat paper gold market fix painting is unsustainable without increasing the amount of manufactured market supply ( alias physical gold) to offset the outflows to the East (Shanghai Gold Exchange)...and we're about to reach the limit of what is technically possible.

Quietly and without fanfare or mainstream media attention, liquidity is migrating to the physical Gold & Silver exchanges away from London and the USA. The fiat paper gold market fix painting is unsustainable without increasing the amount of manufactured market supply ( alias physical gold) to offset the outflows to the East (Shanghai Gold Exchange)...and we're about to reach the limit of what is technically possible.

Talk-down is an act of desperation revealing a weak hand. When there are no arrows left, they try to talk down...and such usually works for some time until the unavoidable happens...like what happened in the 1960s-70s

The global gold market structure has so radically altered that the physical markets have migrated and continue to migrate away from the LBMA conduit into Asia, leaving massive embedded naked-short mismatched lease obligations on the books of the central banks, which are largely shuffled onto the books of the agent bullion banks, the same insider bullion bank’s that are privileged to have gold accounts with the Bank of England.

| Producers can increasingly access non-predatory alternative non-LBMA & COMEX financing and selling conduits in the East. |

Producers can increasingly access non-predatory alternative non-LBMA & COMEX financing and selling conduits in the East. The Shanghai Gold Exchange fix will be settled in yuan and involve 15 Chinese banks but also include at least five of the same LBMA banks that rig the London fix. But there is a major difference. These fix prices will represent delivered physical bars without any paper market dilution, and most importantly all participating banks will be heavily regulated and unable to spoof or paint the fix as they do now.

Updated November 2015

How has China been importing 2,400 tons of gold over the past two and a half years without any upward push to the gold price? This amount equals almost EXACTLY the TOTAL amount of gold mined annually around the world! How is it possible that China has purchased ALL production, and yet the price goes down? The answer, of course, is quite simple...

We have PEAK GOLD.

|

|

Updated April 2015 - It's all about the status of the US-Dollar as World Reserve Currency or the right to pay for Goods and Services with worthless Ink and Paper.

Gold now suffers from a ‘smokescreen’ designed by the US, which stores 74% of global official gold reserves, to put down other currencies and maintain the US Dollar hegemony. For the USA, it is crucial that the dollar dominates the world and so the USA will store gold reserves from countries all over the world to control the gold settlement system.

Both the Societe Generale and the World Gold Council publish FALSE information; they intentionally LIE about the quantities of Gold the Chinese buy annually. The West gets to see different figures from what the Chinese see.

| If you get to see exponentially rising BUY volumes at a time where the Gold price is tanking, you should understand the Gold market is rigged with the help of Paper Gold and Derivatives. |

The market is what it is..manipulated. And the manipulation will last until the manipulation stops working and the Chinese call the cards. This can happen at any time. When it does, the price of Gold will explode upward, more or less like what happened in the 1960s. During those years, it was so bad that Authorities had to call for a bank holiday and close the Gold market. However, this time, the imbalance is so important that I expect a simple bank holiday won't do.

The situation will be so bad Authorities will probably decide to seize your physical Gold holdings and/or levy a special Compensation tax on any sale of Gold. This is the main reason one must keep the bulk of the physical gold "out of political reach" and legally structured is the safest way.

Capitalization of the Gold sector is minimal...as small as the yearly production

| click to enlarge |

This brings us to Gold and Silver miners. These are the second-best way to protect your savings. Actually, these are far better than any paper gold. Miners hold physical gold 'to be mined'. Whatever happens, it is almost impossible to seize Gold which still has to be mined...like it is extremely hard to tax gold ore. And if you tax the mined gold, the mines will go out of business and the Gold supply would fall to zero at a time where demand is soaring. Not only do MINERS offer the next best protection but prices will geyser even higher than the price of gold and gold shares will pay out unseen dividends.

Conclusion:

- There is a dramatic imbalance between supply and demand for Gold (and Silver). This is not reflected by the Market Price, which is rigged by Central Banks and Authorities (paper gold, futures markets, and derivatives) to cover up the poor shape of the financial system.

- It is extremely hard if possible at all to CALL the day where the rigging will stop working. Therefore it is necessary to ensure you are positioning your savings NOW.

- It is also crucial to invest a fraction of your savings in Gold & Silver Miners and to keep these out of political reach.

- Remember that over time, Paper Money will completely disappear and that you will need a legal entity to sell your Gold and Silver positions safely.

Updated December 2014 - what do you prefer: Value or Price...?

Updated December 2014 - what do you prefer: Value or Price...?

GORO rates: because there is a shortage of physical gold, traders % of investors use synthetic Gold (hypothecated gold) to deliver against payment. For this reason, Gold's price goes up (Nov 2014). This will also be the reason WHY the gold price will, at a certain point, become EXPLOSIVE. Expect the Gold miners to move similarly once TIME is up..!

Investors are paying to borrow gold because we have a shortage of Gold and not just a shortage but the biggest shortage in history. The price they are paying is called the GOFO. How is it possible that there is a shortage of gold when gold prices keep tumbling day after day? The answer is simple: the shortage involves gold "available" in the repo market, i.e., physical gold that already has been rehypothecated one ore more times.

|

| click to enlarge |

Central banks rarely purchase gold outright in the open market, unlike Russia and perhaps China via Hong Kong. The bulk of the commercial and central banks rely on intermediaries, all of which merely demand the "presence" of synthetic gold if there is no outright physical gold available. It is this synthetic gold that is now actively disappearing from the system. [remember, the bad money drives the good money out of the system] If central banks were to tip their hand and reveal the unprecedented synthetic shortage to the physical market, the actual cleared market would for sure bid only, and the Gold price would more than double overnight...

Not only is the 1 Month GOFO rate the most negative it has been since 2001, not only is 2 through 6 Month GOFO also negative but the 6 Month GOFO is now negative for the longest stretch in history.

At the same time, the gold backwardation is about to become absolutely historic, with 1 Year GOFO just a whisper away from hitting negative territory for the first time ever at 0.02667%.

The Gold price is likely to explode due to the worldwide sovereign debt.

The gold price is likely to explode as a result of the sovereign debt crisis in Europe, combined with the impact of the negative real interest rates ruling in many major economies...and last but not least, as a consequence of FRACTIONAL GOLD (futures markets, ETFs, Gold derivatives, Gold leasing,...)

| The average marginal production cost of Gold is $ 1200 per oz. |

- You don't buy Gold because the price going up and you're making money but rather because the value of the 'fools gold' Fiat Paper Money is racing towards its real value or ZERO. Mathematically if the value of Fiat currency races to ZERO, the value of a commodity and Gold, in particular, has to race exponentially to 10³¹.

- If we take U.S. gold reserves at 252 million ounces and divide that amount into the national debt of 14 trillion, that yields a staggering amount of $53,639 per ounce. Even taking the world's official gold reserves divided into the US debt of 14 trillion, we still get $15,873 per ounce.

- It will take the USA 8 years to return the German National Gold to Germany.

Along with the International Exchange and the Chicago Mercantile Exchange, JPMorgan now also accepts gold as collateral. The European Commission for Economic and Monetary Affairs has also decided to accept the gold reserves of its member states as additionally lodged collateral. We also regard the most recent initiatives in Utah, numerous other states, and Malaysia and the planned demonetization of silver in Mexico as a clear sign of the times. The foundation of a return to "sound money" seems to have been laid.

Along with the International Exchange and the Chicago Mercantile Exchange, JPMorgan now also accepts gold as collateral. The European Commission for Economic and Monetary Affairs has also decided to accept the gold reserves of its member states as additionally lodged collateral. We also regard the most recent initiatives in Utah, numerous other states, and Malaysia and the planned demonetization of silver in Mexico as a clear sign of the times. The foundation of a return to "sound money" seems to have been laid.

A change they wanted and a change they have. An essential driver of the slow production growth for Gold is the dramatic decline of South-Africa, which produced 1,000 Tonnes in 1970, but below 200 Tonnes in 2010. China has become the world's largest Gold producer, but most of the Gold production comes as by-products from base metal mines, which can be volatile. South African mines traditionally mine LOWER GRADE GOLD ORE when the price of Gold is high and the opposite when the price of Gold is low. A logic policy.

Chinese citizens turn to gold in one of the greatest booms in metal's history - click here for the article.

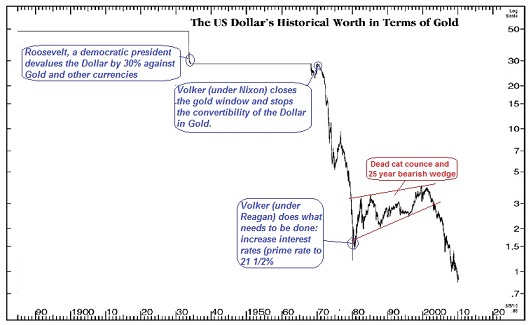

It's not that Gold is up so much; it's fiat paper going down and rapidly falling in a credibility crisis for major currencies that underlie the Western financial system. Hard to understand! The public has been lied to and cheated by the Central Banks for decennial now...and the chickens are coming home to roost!

Even today, as the gold rally has reached the 10-year mark (following a 20-year bear market), the metal represents a mere 0.6 percent of total global financial assets (stocks, bonds, and cash). This is near the all-time low (0.3 percent) reached in 2001 and significantly below the 3 percent it accounted for in 1980 and the 4.8 percent it was in 1968

-

- The USA holds 8,133 Tonnes of Gold (27%)

- The Eurozone holds 10,542 Tonnes of Gold (35%)

- Non-G7 holds 3,411 Tonnes of Gold (11%)

- China holds 512 Tonnes of Gold ( 1.7%)

- Russia holds 790 Tonnes of Gold (2,62%)

- The total official known reserves are 75%

If you want to understand why gold is rising despite a few signs of price inflation, it boils down to understanding how money is valued. (March 4, 2010)

The quantity theory of money, believed by monetarists, suggests that too much money chasing too few goods will produce inflation in time.

The Fed, the EU, and the UK are printing money like drunken sailors, but the signs of hyperinflation are nowhere to be seen. Yet, despite this, the price of gold continues to climb. Why? On the margin, people are becoming increasingly skeptical of Fiat Money's (dollar, Euro, Pound) ability to preserve value over time. Gold has not gone parabolic (yet), often resulting from hyperinflation, because people have yet to believe that Fiat paper money is "cooked" or worthless. There lies the basic description of the subjective theory of the value of money as presented by the Austrian School of Economics. Today the Authorities don’t recur to the physical printing of Money. Instead, they multiply DIGITAL MONEY by clicking “Enter.”

If you have no Gold, you have no money - but which scenario should you follow with Gold at today's peaks? (November 23, 2009)

Gold is making new highs almost every day in Dollars, Euro, British Pound, Swiss Franc, Canadian Dollar, and Rupee and has now also broken out when expressed in Australian Dollar and South African Rand. Technically it becomes tough to forecast any corrections and at which level these may happen (it is absolutely not sure we will see essential corrections between now and the Spring of next year, and Central Banks have put a parachute at $ 1,045 under the Gold price by buying 200 tons from the International Monetary Fund at this level). Bravo to the idiots of the IMF for selling the tax payer's gold!

I feel that we could see the reverse of 2008 deleveraging: Gold and Silver came down and kept going down, burning all support levels and staying oversold. We could now see the Gold and Silver rise and stay overbought for some time. [Remember, this is precisely what happened when the Gold pool failed to control Gold at $ 35].

As indicated below, there is ONLY so much GOLD and Silver, and the capitalization of the Gold sector is minimal. Once the Herd moves in, we will indeed see spectacular figures.

- To be safe, you should allocate at least 50% of your assets to Gold and Silver.

- Buy more if the Gold price comes down, but don't exceed your monthly limit, and don't chase the price.

- Make sure you allocate part of the amount to Gold and Silver mines. As the price of Gold and Silver increases, their Earnings and Dividends will also.

- If you want something more spectacular, buy some Gold and Silver Juniors. But do your homework before doing so.

- Check our calculated technical objectives and adjustments regularly.

- Don't forget and DO SELL, and don't be stubborn when the time has come.

- Ask us for our advice if you are in doubt.

- Invest more and/or use the balance only if Gold corrects to $ 1,075, $ 1,045

- example: 100,000 in total - buy 5,000 per week or 20,000 per month.

- Buy only NEW Gold coins with the lowest premium if Silver is taxed in your country.

- Make sure you also buy Gold and Silver equities, which will generate a nice income over the next years.

- DO IT NOW!...don't wait for $ 2,000!!!DO NOT TRADE: Buy and sit tight; ride the wave all the way.

Total Gold Stock on Earth

From the most recent work of the Gold Anti-Trust Action Committee, there are strong indications that the London bullion market operates on a fractional-reserve basis.

From the most recent work of the Gold Anti-Trust Action Committee, there are strong indications that the London bullion market operates on a fractional-reserve basis.

It would appear that at least 64,000 Tonnes of gold have been sold via unallocated accounts against a maximum reserve of only 15,000 Tonnes.

The cataclysmic event in gold could be triggered by an audit or simply by purchasers asking for delivery of their gold.

In the world, there are currently around 140,000 Tonnes of gold ‘above ground.’ To visualize this, imagine a single solid gold cube with edges of about 19 meters (about three meters short of the length of a tennis court). That's all that has ever been produced.

Divided amongst the world's population, there are about 23 grams per person, about 1.2 cubic centimeters each. The World is indeed running out of GOLD and Silver.

Over the past decade, private bankers have emptied national treasuries of gold bullion, selling it on the open market to keep the price of gold low to mask the increasing vulnerability of their paper-based assets.

The US claims the US Treasury still holds approximately 7,000-8,000 tons of gold but has not allowed a public audit of its reserves since 1954, and since 1999, the UK and Swiss have seen their gold reserves decimated as bankers freely sold their gold to cap the rise in the price of gold to keep the banker’s paper money scheme intact.

But most investors will continue to play the banker’s game with the banker’s paper money and continue to invest in paper assets as it is the only game they know. They don’t know that the banker’s game is almost over, and, for those who understand what is happening, this is the opportunity of a lifetime to profit—and to survive. Darryl Robert Schoon

January 18, 2009 - Biggest fall in SA gold since Boer War - Allan Seccombe - Posted: Thu, 15 Jan 2009

[miningmx.com] -- SOUTH Africa has dropped into third place of the world’s gold producers after the biggest drop in bullion output since the Boer War in 1901, London-based precious metals consultancy GFMS said on Thursday.

[miningmx.com] -- SOUTH Africa has dropped into third place of the world’s gold producers after the biggest drop in bullion output since the Boer War in 1901, London-based precious metals consultancy GFMS said on Thursday.

This is a poor showing for the country that dominated gold production for a century, but it has seen output taper off as mines became deeper, more expensive, and dangerous to operate. In 2008, South African mines had to contend with a week-long shutdown because of electricity shortages in January and then curtail power consumption by 10%, which lowered production at some companies.

Without giving figures, South Africa is number three behind China and the United States, GFMS said in its Gold Survey 2008. China claimed the number one spot in 2007 when its production rose to 276 tons against South Africa’s eight percent fall to 272 tons.

“South Africa faced a crushing year, with production plummeting by an estimated 14%, the sharpest percentage fall since 1901 when the country was still embroiled in the Second Boer War,” the consultancy said.

Based on figures from the South African Chamber of Mines website, the largest fall came between 1899 and 1900, when gold output fell 90% to 10.8 tons from 113.15 tons. It then dropped to eight tons in 1901 before rocketing back to 53.44 tons a year later.

The Boer War ran from October 1899 to May 1902 between Britain and two Boer republics, with gold, to some degree, lying at the heart of tensions.

South Africa’s production is now at its lowest in 100 years, GFMs said, basing its assessment on preliminary 2008 figures and its archives. South Africa produced 1,000 tons of gold at its peak in 1970 and has been declining ever since.

China has boosted its gold production because of increased foreign investment there, while South Africa has experienced a decline because of cost pressures and a vigorous government approach to safety, which entails shafts being temporarily shut after fatal accidents.

Overall, gold production last year from mines worldwide fell to its lowest level since 1995 because of technical issues, skill shortages, power constraints, and a weakening global economy that made financing difficult.

China, however, boosted production by three percent, and new mines came into production in Russia and Mexico, which should give a temporary boost to supplies.

December 19, 2008

The two most essential prices in the world of finance are the price of US government debt and the price of gold. The two are inversely correlated, but gold prices tend to lead to price changes in Treasuries. Gold appears to have bottomed in November 2008, suggesting a future topping out of Treasury prices. The gold price rise should accelerate as the Treasury bubble begins to collapse. These are the two sides of the same coin for the most crucial financial story in the coming year. Buy gold, sell Treasuries sooner rather than later.

The two most essential prices in the world of finance are the price of US government debt and the price of gold. The two are inversely correlated, but gold prices tend to lead to price changes in Treasuries. Gold appears to have bottomed in November 2008, suggesting a future topping out of Treasury prices. The gold price rise should accelerate as the Treasury bubble begins to collapse. These are the two sides of the same coin for the most crucial financial story in the coming year. Buy gold, sell Treasuries sooner rather than later.

We see the Backwardation of the Gold price as proof that the paper Gold price clashes with the physical Gold price. This has profound implications. Professor Fekete recently posted his article, Red Alert: Gold Backwardation!!!, in which he alerted readers that for the first time in history, the cash price of gold is higher than the nearest futures price, indicating that buyers value the present physical possession of gold more highly than future possession.

Professor Fekete stated that when gold recently moved into backwardation on December 2nd, a historical line had been crossed, a line which signified whether or not the present system could be saved. According to Professor Fekete, with gold in backwardation, it cannot.

While the war between paper money and gold and silver is still being waged, according to Professor Fekete, the outcome is no longer in doubt as the present system is now beyond redemption. This has profound implications for the future price of gold and silver and for gold mining shares.

Permanent Backwardation is expected soon.

Physical gold and silver, whether in hand or in the ground, will be the last refuge for the trillions of dollars still invested in paper assets. With an estimated $27 trillion of wealth already lost this year, the day is coming when the last believers in paper assets will finally look to gold and silver to preserve their dwindling wealth.

But when that day comes, those owning monetary metals will not exchange their gold and silver for paper money at any price, i.e., permanent backwardation; the last believers in paper assets will be stuck with now worthless government-issued coupons that previously had passed for money.

The recent historic backwardation of gold is a clear indication that sometime in the future, a state of permanent backwardation will occur—and on that day, the world will finally be free from the tyrannical slavery of central bank-induced indebtedness.

The shares of Homestake Mining went from $ 4.19 in 1929 to $495 in 1935, paying a $56 dividend that year.

During the last Great Depression, the shares of Homestake Mining, the world’s largest gold mine, went from $4.19 in 1929 to $495 in 1935, paying a $56 dividend that year. In the coming depression, gold and gold mining shares should do just as well—and, after the onset of the depression, just imagine what they will do during hyperinflation. Real Negative Interest Rates are the main engine for Gold & Silver. “Rescue Will Send Gold to Surreal Price Level”

During the last Great Depression, the shares of Homestake Mining, the world’s largest gold mine, went from $4.19 in 1929 to $495 in 1935, paying a $56 dividend that year. In the coming depression, gold and gold mining shares should do just as well—and, after the onset of the depression, just imagine what they will do during hyperinflation. Real Negative Interest Rates are the main engine for Gold & Silver. “Rescue Will Send Gold to Surreal Price Level”John Embry of Sprott Asset Mgmt focuses on the extreme amount of nationalization and other bailout funding by the US as a prelude to a potential gold futures default. He said to watch the December COMEX futures contract. The old saying is that gold responds to the medicine applied but not the prescription written.

“Gold doesn’t need to go to $1,200 or $2,200 to prove itself. Gold can simply survive in an era where all other paper assets fail."

"The entire world is going through a generational and even a once-in-a-hundred-year cyclical change right before our eyes, and we witness these historical events. All of these gold and financial sites, for over 10 years, have been predicting that this financial meltdown was coming.

And don’t fool yourself here. The most important element for survival for those who survived the 1930s were those who were out of debt and had assets that were paid for free and clear. "

“ The US authorities will not hesitate to debase their currency in an attempt to salvage the financial system. In the fullness of time, this will be wildly inflationary and should propel gold and silver prices that would be viewed by many in today’s context as surreal.”

November 1, 2008: The COMEX gold & silver markets are each hurtling down a dangerous path toward default.

The artificial paper price has created enormous physical demand and hampered supply production if not delivery. The gap between the JPMorgan-led corrupted phony paper price and the legitimate physical price in actual trading markets has grown sharply, enough to force a breakdown like in any distorted market. When December contracts in gold & silver are demanded to be satisfied via delivery of the metal, it will be apparent that COMEX is running a scam. A default is highly likely. Of course, they can continue to deny contract holders the right to benefit from delivery, as they have been doing for months to ‘Non-Economic Customers,’ but soon the ‘Commercial Customers’ will be defrauded. Arrests are warranted. We will see how this corruption unfolds.

Gold is the ultimate currency, the only REAL MONEY. It has no liability attached to it and is universally fungible. Gold reached a new high expressed in Euro, Pound Sterling, and Australian Dollars. Historically, Gold goes up together with the interest rates!

The War between paper gold and bullion gold is a war to determine which will take command of the price of gold, nothing more, nothing less—the more massive the paper manipulation, the more violent the coming correction. The asylum managers are losing control of their paper-physical arbitrage.

For Gold, the price today should be $ 2,250 to match the 1980 high of $ 840. If one were to use the statistics maintained by John Williams at Shadowstats.com, the numbers would be $ 5,000. We maintain a 1:1 relation to the Dow Jones Industrials; hence it should be $ 9,000 +.

October 2008: The gap between the physical and paper gold markets is widening.

We maintain a 1:1 relation to the Dow Jones Industrials; hence it should be $ 8,000 + (Oct 2008). In Toronto this week, a major off-market gold transaction took place. The price paid was $1075 per ounce on the physical transaction. Its volume was in the multimillion $. There was no US involvement in the transaction, and the settlement was in euros.

Make sure the accumulation of gold and silver bullion is a monthly regimen because, because mark my words, it will be next to impossible to obtain some years from now.

Posted October 1st and updated October 3rd, 2008

So why isn't the Gold price running? Bill Murphy, the chairman of the Gold Anti-Trust Alliance, says it proves the point the alliance has been making for years now. It is being kept artificially in check by central banks and bullion banks. He also says this control cannot be sustained for much longer and that the gold price could soon be unleashed from artificial restraints. He points to Monday's gold price fluctuations as an example of the control of its movement. The gold price was fixed at $905/oz in London’s afternoon market, only to fall to $894 shortly afterward. “It just doesn’t make any sense,” Murphy said.

“The gold cartel goes into the derivatives market and takes the price right down again. They’ve been doing it now for a week,” Murphy told Miningmx. “The gold price should be well over $2,000 now. “They’re (the cartel) getting to the point where they’re going to hit the wall, where this physical demand is going to take them out,” he said. “It’s going to be above $900, above $900, above $900, and then the dam’s going to explode. Maybe they’re just trying to hold it together until this bailout is approved and over with.”..click here for more...

Posted October 23, 2008

John Embry of Sprott Asset Mgmt has raised the possibility of a December gold futures contract default. He is not predicting it or claiming it as certain but instead mentions how talk centers on the December gold contract as having extreme stress for actual delivery. The pressure is building. The December contract is not only the end of the quarter but the end of the year. He suggests a possible default. He said, “There is probably going to be such an event to change perceptions.” He cited a possible force majeure that could act as a “seminal event that defines the whole situation.” He explained that the physical gold price would then dictate the paper gold price, a return to normalcy, and a gigantic increase in the gold price. The paper gold market is currently overwhelming the physical side, but the physical side is constricted on supply. He explained that hedge funds are being unwound on a massive scale, slaughtered by margin calls. The long side must call for delivery on many contracts. He also expects many questions on the Exchange Traded Funds soon, although those are surely not as important as the COMEX contract defaults. Watch and listen to his interview on the Canadian Business News Network (https://watch.bnn.ca/tuesday/#clip104603), and be sure to move to the 10 to 11-minute mark.

Posted October 3, 2008

Flight to Cash is the order of the day, and Gold ultimately is a beneficiary, albeit with infuriating bouts of $100 price swings. IMPORTANT is to understand we have a DE-LEVERAGING of the balance sheets of Banks and Hedge funds. This huge GARAGE sale will decrease in intensity once the Bailout plan is operative and the freshly created liquidity seeps into the system. However, at this point, ALL VALUABLE assets are sold (incl. Gold), and the funds repatriated (read: Euros and other Forex exchanged for Dollars). This action has a double, illogical action: it pushes down the price of Real Money and increases the price of Fiat paper money (DOLLAR) or debt. This also explains why the volatility of Gold is the greatest when expressed in Dollars.

Additionally, we see a disconnect between the physical Gold price and the paper Gold price. Non-believers can check this out on eBay.

Posted September 27, 2009

Buy physical GOLD NOW before it is too late! Gold sits in a bullish triangle. As it tried to break out, the price was promptly smashed back by the PPTeam. Their power is largest on a Friday afternoon. The shortage in the physical markets persists (US Mint suspends Buffalo), and sooner or later, the paper market will have to catch up. Again, we cannot believe the markets stay this resilient as the biggest drama since the Great Depression of the 1930s is unfolding.

Updated November 7, 2008

"There is a rationing of Gold in Dubai...Silver dealers have run out of stock..." The world's largest gold refiner runs out of Krugerrands.

"There is a rationing of Gold in Dubai...Silver dealers have run out of stock..." The world's largest gold refiner runs out of Krugerrands.

Last year, world production of gold sank to the lowest since 1937 as reserves were depleted, and few new sources of gold have been found.

But while professional and institutional investors trading paper bet on the Gold Price scrambles to reduce their positions, private individuals are creating a squeeze in physical metal right across Europe and North America.

The US Mint has reportedly halted American Gold Eagle coins sales and is said to be refusing new orders from gold bullion dealers.

Kitco Inc., one of the largest gold investment retailers in the USA and Canada, warns on its website that "due to market volatility and higher demand in the entire industry, we are anticipating delays in supply of all bullion products."

"Once inventory is received, there may...be delays in processing and shipping by our vaults."

Meantime, in Germany, the Pro Aurum dealership based in Munich says that its website hit a "meltdown" last week thanks to record-high traffic. It claims the same problem hit other German gold retailers, too.

"We've seen a dramatic increase in the number of orders. We called in our gold-dealing team to work the Assumption Day holiday [on Friday]. All our branches saw prolonged waiting times for over-the-counter cash sales, and this will surely continue over the coming week."

Chart: A long-term idea of Gold Supply and Demand. See how production and supply come down each time Gold spikes up.

© - All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic