Silver Fundamentals

Updated August 2023: As long as the price of Silver stays under $30, the exploitation/mining of the metal is uneconomic!

About the American Silver Eagle

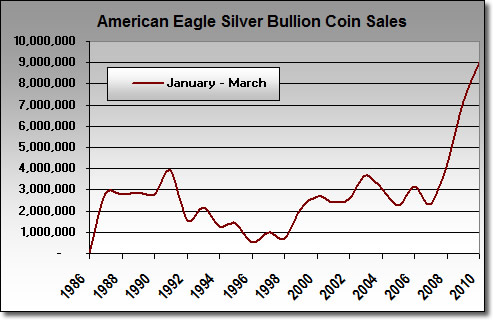

1. The American Silver Eagle (ASE) 1 troy oz silver coin produced by the US Mint is the primary bullion investment for many small investors in America. ASE investment is substantial. Over 619 million coins have been bought, valued at over $15 billion. The silver invested in ASEs contains 17 times more silver than the registered silver backing the entirety of Comex silver trading.

2. The US Mint is bound by the Liberty Coin Act (statute 99-61) to meet the market demand for ASE coins.

3. Until recently, the US Mint dutifully complied with the law regarding production volumes. Over nearly 4 decades, the Mint overcame significant challenges, such as increasing production by 450% between 2007 and 2016 and substantially increasing production during the COVID-induced supply chain disruption in 2020.

4. In February 2021, a grassroots movement called “Silver Squeeze” commenced on social media, with the group investing in a multitude of silver products, including ASE coins. The increased coin demand drove market premiums as high as 30%, far above typical coin premiums.

5. Over the following 8 months through September of 2021, there was minimal production increase from the Mint despite the continued elevated coin premiums.

6. The Director of the Mint, David J. Ryder, resigned on Sept 24, 2021. His replacement was Ventris Gibson.

7. Immediately after the change in Director, the Mint’s coin production was cut by 50% from an average of 2.6 million coins per month to 1.3 million. Coin premiums soared as high as 75%, more than 6 times the typical market rate.

8. The Mint’s coin production over the 21 months of Ventris Gibson’s term is the lowest since 2018 and only a small fraction, 34%, of the Mint’s prior production in 2015. The restricted production has occurred even though coin premiums have been at record high levels for 3-1/2 years.

9. The Mint is in violation of the law by restricting production below demand. Investors have paid $350 million in excess cost to buy products from the Mint.

10. Most importantly, investor demand is not being met. Investor demand is currently 270 million oz greater than supply. Small investors have been deprived of $7 billion of ASE coins. A simple question … Why would the Mint’s production of American Silver Eagles be at a 5 year low during a period when coin premiums have been the highest ever?

The US Mint is a Bureau of the Treasury Department. The US Constitution defines the dollar as 371.25 grains of pure silver. Millions of small investors are now forced to bid against each other to purchase American Silver Eagle coins.

Updated December 2022

|

The role of silver is to divide gold for retail transactions.

|

||

Updated May 2022

|

|

Updated May 5, 2021

Updated February 12, 2021: If these fundamentals don't send Silver to the Moon, nothing will.

|

|

| No stock of silver... | Tons of naked shorts |

|

|

| Huge manipulation. | A mining deficit. |

|

|

| See how Silver soars each time there is backwardation. | Target is $50 and $86 next |

Is Silver the next Gamestop!? Jan 8, JPMorgan dumped more than an entire year of mining production. REMEMBER TO BUY ONLY PHYSICAL SILVER - CONTACT US FOR MORE.

|

|

"Inflation-adjusted Silver should be at $1,000 instead of 25$."

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know bullion banks are manipulating gold and silver to cover real inflation.

All of the best mines for silver have already been depleted in recent years. There is a severe supply shortage developing. At the same time, demand is skyrocketing. Solar panels, electric cars, electronics, and many other products need more silver than ever. In both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

The supply of Silver is INELASTIC!

|

|

|

|

Supply Crunch For Silver Developing

- The outlook for silver looks supportive in our opinion and the following tables highlight why that is. Silver is mostly mined as a by-product of other major metals such as zinc, lead, copper, and gold. In fact, only around 30% of mined silver comes from pure silver mines. The 20% drop in the LME London Metals Index since January and the current recessionary outlook may inadvertently lead to a supply crunch for silver as production slows.

- Silver’s industrial demand going forward is increasingly going to come from the alternative energy sector, especially towards its growing use in photovoltaic solar cells. Apart from that silver is also the best natural conductor of electricity and heat. It’s generally being used in electronics, batteries, LED chips, semiconductors, and electric vehicles.

The top primary silver miners in the world saw their production yield fall to the lowest level ever in 2018. Since 2005, the average yield from the top silver miners has fallen nearly in half. And along with rising oil prices, have pushed up the total cost to produce silver by an additional $10 an ounce. So, for those who still believe in the fantasy that it cost $5 an ounce to produce silver, that data shows otherwise.

|

|

|

|

-

|

|

Silver is extremely scarce! What makes silver particularly interesting is its scarcity. Around 170,000 tons of gold have been produced in history and virtually all of this quantity is still around in one form or another. This is not the case with silver. There are no significant silver stocks anywhere in the world. Almost 60% of the silver produced is consumed, the rest goes to silverware, jewelry, and investment. Central banks hold no silver stocks. The annual global silver production is 27,000 tons which at $17 is $15 billion. As a comparison, annual gold mine production is $114 billion. More silver has been consumed globally than has been produced for a number of years. The investment demand for silver is only $2.5 billion annually. The total size of the silver market is minuscule in relation to world financial assets. That is why it has been very easy for Deutsche Bank, UBS, Barclays, and a few other banks to manipulate this market. Deutsche has admitted their rigging of the silver market but since they have implicated a number of other banks, we haven’t seen the end of this story which is very likely to spread to the gold market also.

Silver is normally the leading metal. It moves faster down in a bear market for precious metals and when the market turns bullish, it outperforms gold. The fall of the gold/silver ratio indicates that the manipulation might soon come to an end which will lead to increased physical demand. That in turn will put the paper silver market under severe pressure. As physical demand rises, the silver price will increase rapidly. Even today it is difficult to find big quantities of physical silver and as the price rises, there will be no silver available at current prices. Any surge in demand will only be satisfied at substantially higher prices.

August 9, 2017 - Silver production of the 4 largest Silver miners decreased by 50% over the 1st half of 2017.

Silver production of the 4 largest Silver miners decreased by 50% over the 1st half of 2017. When mining becomes a loss, miners simply stop mining... and because PRICE is rigged, Supply dries up. According to the most recently released data from Chile’s Ministry of Mining, the country’s silver production declined a stunning 26% in the first quarter of 2017. This is a big deal as Chile is the fourth largest silver-producing country in the world. The majority of Chile’s silver production comes as a by-product of copper production.

Not only is Chilean silver production (Plata) down 26% in the first three months of the year, but gold mine supply (oro) is also down 22%. While a 22% decline in Chile’s gold production is substantial, the country only produced 43.3 mt (1.4 million oz) in 2016, compared to 1,496 mt (48.1 million oz) of silver.

Chile isn’t the only country suffering from falling silver production this year. As I stated in a previous article, Huge Decline In Peru’s Silver Production Suggests Future Production At Risk, Peru’s silver production declined 12% FEB 2017 versus the same month last year.

|

|

Silver should not be bought for speculative purposes but for long-term wealth preservation. Due to the volatility of silver, 15-25% of total precious metals holdings is the right level in our view. For any investor who doesn’t hold silver, it is my strong belief that now is an excellent time to buy physical silver at a price that will never be seen again and for a journey that will be extraordinary.

|

|

|

|

| click to enlarge | |

During the third quarter of 2013, the all-in cash costs of the silver producers are $20.08 per ounce. With silver languishing at approximately $19, most major miners are losing money on every ounce produced.

Posted June 3, 2011 - we have Peak Silver

- In 2010 Silver produced from worldwide mining totaled 667 million ounces. Silver is used for a manifold of applications ranging from biocide to solar panels. Industrial use will rise 36% over the next five years and the annual industrial demand/consumption is expected to range around 667 million ounces.

- In 2010 total demand for Silver was 986 million ounces.

- Silver production in Mexico, Australia, China, and Argentina is rising. It is declining in Peru, the US, and Canada.

- The average cost to produce Silver from primary silver mines is $ 5 to $ 10 per ounce.

- Governments hold only 355 million ounces of Silver.

- The top three silver producers are Peru, Mexico, and China

- July is traditionally the best month to buy Silver

Posted December 7, 2010

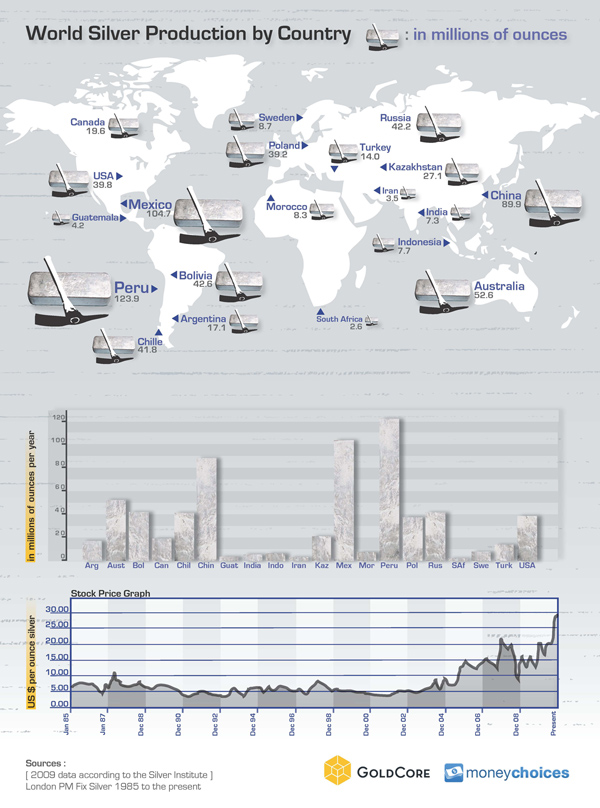

Silver traditionally follows in the wake of Gold. A major problem silver has, is that a purchase is unfortunately heavily taxed in many countries. Taxes can be as high as 21 %. The USA plans to stop the production/sale of Silver coins...and such is actually already happening from time to time. World Silver production

| World Silver production | Silver Eagle premiums |

|

|

-

Last but not least we have the fundamentals and for this, we refer to the other sections of the site (Academics, Hyperinflation, Fractional Reserve banking), we have seen a parabolic rise in the money supply. Charts are a cracker. Never have I seen this kind of explosion. Academically there is absolutely no doubt in my mind that this will result in higher inflation and probably hyperinflation.

-

According to the London Bullion Market Association website, silver has been trading in backwardation since December 8th. This condition is extremely rare. The existence of this backwardation suggests that the possibility of a short squeeze is real; if so, the potential exists for the price of silver to rocket higher as shorts scramble for physical metal to cover their position. Many analysts see a greater potential for Silver than for Gold. (Sep 2009).

-

The supply of Silver is drying up and Demand is increasing dramatically. Even if we admit the Deflation theory (where paper money is revalued), Silver remains a steal at the actual price. Silver coins sell at a high premium. [Some talking heads incorrectly state that Silver came down because we are about to see a Deflationary cycle. With all the bailouts (the initial cost of bailing out Fannie & Freddie is $ 200 bn), there is absolutely NO chance to see a deflationary cycle. Having said this, Silver is a protection for both DEFLATIONARY and INFLATIONARY cycles]

We see the Backwardization of the Silver price as proof that the paper Silver price is clashing with the physical Silver price. This has serious implications.

The cash price of silver is higher than the nearest futures price, indicating that buyers value the present physical possession of silver more highly than future possession.

While the war between paper money and gold and silver is still being waged, according to Professor Fekete the outcome is no longer in doubt as the present system is now beyond redemption. This has profound implications for the future price of gold and silver and for gold mining shares.

Permanent Backwardation is expected soon.

Physical gold and silver, whether in hand or in the ground will be the last refuge for the trillions of dollars still invested in paper assets. With an estimated $27 trillion of wealth already lost this year, the day is coming when the last believers in paper assets will finally look to gold and silver to preserve their dwindling wealth.

But when that day comes, those owning monetary metals will not exchange their gold and silver for paper money at any price, i.e. permanent backwardation; and the last believers in paper assets will be stuck with now worthless government-issued coupons which previously had passed for money.

The recent historic backwardation of gold is a clear indication that sometime in the future a state of permanent backwardation will occur—and on that day, the world will finally be free from the tyrannical slavery of central bank induced indebtedness.

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic