GS Share Fundamentals

Updated October, 2023

- The exploitation costs of the Miners have gone up exponentially because of Higher Energy costs and green and Environmental legislation.

- We have PEAK Gold/Silver, and the reward of the mining activity is lower: more material has to be mined for the same amount of metal.

- Miners (except when registered in your name) have become DIGITAL entities and can be seized at all times by Authorities. Therefore, investors are better protected by buying physical metal and storing it out of political reach.

Mining stocks surge as gold jumps above $1,900. Although the Miners will perform well during the coming days of higher Gold and Silver, we judge the risk of holding these digital entities in a time of expensive energy and green environmental politics TOO HIGH. Today, any digital asset has become easy prey, and politicians will not hesitate to seize these when necessary for the survival of the financial system. Physical Gold and Physical Silver is the only way to go!

- Miners are negatively affected because they are digital entities and can easily be seized, they are adversely affected by high energy prices, they are adversely affected by environmental legislations, they are adversely affected by the lower ore grade,...

© - All Rights Reserved - The report's contents may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic.

Updated January 2022 - We have Peak Gold!

- Agnico Eagle has grown through acquisitions, using their exploration team’s expertise to grow the acquisitions. The Detour Lake acquisition came as part of the Kirkland Lake deal, which closed early last year, giving them over 70% of their production from Canada.

- Barrick Gold Corp. The world’s second-largest gold player’s strategy focused on about half a dozen Tier 1 or high-quality assets and organically grew production because of the difficulty of making growth through acquisitions payoff. To avoid geographic and financing risk, Barrick partners and shares that risk, and as an example, the company’s expansion at Pueblo Viejo in the Dominican Republic grew organically through plant expansion and similarly with the giant joint venture Nevada Gold Mines.

- B2Gold Corp. B2Gold has been searching the globe for assets, having disposed of lower-quality assets like (Calibre) in Nicaragua. B2Gold is expanding its flagship low-cost producer, Fekola in Mali, processing nearby Anaconda satellite material at the Fekola complex. Total cash costs remain below $600/oz.

- Eldorado Gold Corp. Eldorado is a mid-tier player with four producing mines at Lamaque in Quebec, two mines in Turkey, and Olympias in Greece. Eldorado produced 135,000 ounces, with a continuing shortfall from Kisladaq.

- IAMGOLD Corp. IAMGOLD announced the sale of assets in West Africa, including the Boto gold project, to Moroccan Management for $282 million following the sale of Rosebel to the Chinese. IAMGOLD management also sold 10 percent of the Côté Gold project to partner Sumitomo for $250 million to close the financing gap and help finance Côté.

- Lundin Gold Inc. One of the richest gold producers in the world has all-in costs of less than $700/oz and will pay dividends on a solid cash flow performance. Lundin produced 421,000 ounces last year at 10 g/t and will boost production this year.

- Kirkland Lake Gold Ltd. (“Kirkland Lake Gold” or the “Company”) (KL) today announced that at a special meeting of shareholders held earlier today, the Company’s shareholders voted in favor of the arrangement resolution approving the proposed merger of equals whereby all of the issued and outstanding shares of the Company (the “Kirkland Shares”) will be acquired by Agnico Eagle Mines Limited (“Agnico Eagle”) for common shares of Agnico Eagle (the “Agnico Shares”) in a merger of equals for consideration per Kirkland Share equal to 0.7935 of an Agnico Share. The Arrangement is expected to be completed during the first quarter of 2022, subject to approval by the Ontario Superior Court of Justice, approval of the Australian Foreign Investment Review Board (“FIRB Approval”), and satisfaction or waiver of certain other closing conditions.

- Pretium (PVG) will be taken over by Newcrest (NCM.TO) for CAD $18.50 cash and shares.

VANCOUVER, BC, April 7, 2021 /PRNewswire/ - Equinox Gold Corp. (EQX) (NYSE American: EQX) ("Equinox Gold" or the "Company") has completed its acquisition of Premier Gold Mines Limited (TSX: PG) (OTCPK: PIRGF) ("Premier"), adding Premier's interest in the construction-ready Hardrock Project in Ontario, Canada, the producing Mercedes Mine in Mexico, and the Hasaga and Rahill-Bonanza exploration properties in Ontario to the Company's existing portfolio of gold assets. Going forward, Hardrock will be called the Greenstone Project, a name well-recognized in the region and supported locally. The spin-out of i-80 Gold Corp. ("i-80 Gold"), a newly created company holding Premier's gold projects in Nevada, USA, was also completed in connection with the acquisition. Equinox Gold is a 30% shareholder of i-80 Gold.

"There is less and less Gold and Silver that can be mined. The production of the miners will decrease and mining costs rise exponentially!"

Coeur Mining (Analyzed 6/1/2020)

Coeur Mining has underperformed since 2006. They have to reach $70 per share just to return to where the share price traded in 2006. However, they have aggressively purchased Orko Silver, Paramount Gold, and a mine from Gold Corp. Plus, they tend to have a weak balance sheet, which is currently $450 in debt and only $150 million in cash.

Their share price should take off if they can clean up their balance sheet. But they tend to be spenders and not shareholder-friendly. Also, they like to hedge, with almost a third of gold production hedged in 2020. Even with these negatives, it’s a stock you probably have to own because of its leverage to higher gold/silver prices. In 2020, they will produce about 12 million ounces of silver and 350,000 ounces of gold. That is substantial, and with rising gold and silver prices, cash flow could reach $1 billion annually at higher gold/silver prices. At 10x cash flow, they could reach a $10 billion market cap. That would make them a potential 5+ bagger from their current $1.5 billion FD market cap. The stock had been surging, rising from $2.48 to $14.94 in 2016, but is now down to $5.95 because of high costs and not a great balance sheet. They are currently producing about 35 million oz of silver equivalent (including gold), with all-in costs (free cash flow) around $16 per oz. So, they are a high-risk investment at low gold and silver prices. However, if gold and silver prices take off, they will benefit big time. I look for this stock to do well, although they need to find some production growth. They have become mostly a gold producer, with more revenue from gold than silver. However, that could even out if silver outperforms gold. The best thing about this company is that it has 96% of its revenue from gold and silver and very little from base metals.

First Majestic Silver (Analyzed 10/10/2020)

First Majestic Silver is a large silver producer in Mexico. Until recently, they were a solid company with a clean balance sheet and low costs. Now, they have $150 million in debt and lost money last quarter (June 30th), although they do have $94 million in cash. Their all-in costs are around $17 per oz (silver equivalent). Hopefully, that will drop when their next quarter's financials are released. They will produce 25 million oz of silver equivalent in 2019 (93% of their revenue comes from silver and gold). With this much production, they have huge leverage for higher silver and gold prices. They have 6 producing mines in Mexico. They can potentially create over $1 billion in free cash flow at $100 silver prices. At a 10x free cash flow valuation, FM should be worth at least $10 billion at $100 silver. That is my expectation as long as Mexico doesn't increase taxes and royalties and FM hits its production and cost targets. The red flag for this stock is its high all-in costs, but they have one of the best management teams in the business and should survive a downturn. Their other red flag is their resource total. They only have about 170 million oz (silver equivalent) reserves. That seems like a lot, but they plan to increase production beyond their current 25 million oz (silver equivalent) yearly. That is only 7 years of current reserves. Thus, maintaining production could be an issue down the road and could hurt their share price. After all, few large silver mines are left to develop. The good news is they want to become the world's largest silver miner. That is an aggressive goal. They will need to get lucky with exploration and acquire a few projects. With that aggressiveness, I would expect this company to do well. If they can grow their resources and production, my future valuation (around $10 billion) is too low for them.1/4/2020: I was informed that FM has a large potential tax liability from their Primero acquisition and how the silver stream is taxed (from 2010 until current). On their most recent MDA on Sedar.com, they list a potential $185 million tax liability and that it does not include interest and penalties. Ouch. I doubt they will have to pay the entire amount, but the liability appears to be growing because they have not changed their accounting to match what the Mexican tax authority deems appropriate. Currently, they are negotiating with the Mexican tax authority regarding this liability, and it appears they have refused to pay it.

Hecla Mining (Analyzed 1/1/2020)

Hecla Mining is a silver and gold mining company (about 50/50). They used to be a low-cost silver producer but have been losing money. They have a poor balance sheet with $584 million in debt and only $33 million in cash. A lot of that debt is due in 2021, so this stock has a very high risk if they can't roll it over. To make matters worse, their large Lucky Friday mine (6 million oz producer) has been down for more than a year due to a labor strike.

2018 and 2019 were terrible years for Hecla. In fact, they almost went bankrupt. Their share price crashed to $1.31 in 2019. If it went under $1, they might not have recovered. Hopefully, their fortunes will turn in 2020. Their Greens Creek mine in Alaska is world-class. That mine alone is probably worth their current market cap. They have huge resources (10 million oz of gold and 450 million oz of silver). But their all-in costs and balance sheet have been hurting their share price.

This is a company with huge leverage for higher silver prices. They have several development projects. In the long term, they could easily double silver production. They have two large silver projects in Montana that are being permitted. And they recently acquired Klondex Mines, which has big potential in Nevada for increasing gold production. For some odd reason, they don't even include their Montana projects (Montanore and Rock Creek) in their current presentation. They just need to survive these low precious metals prices. I'm concerned with more share dilution. If gold and silver prices don't rise in 2020, they could have trouble rolling over their debt that is due in 2021. If they get their debt under control, they have significant upside potential. In 2020, they will produce about 10 to 11 million oz of silver and 250,000 oz of gold. If Lucky Friday resumes production, that would increase silver production by another 4 to 5 million oz. We won't know their all-in costs until they can show some free cash flow. My guess is they might make a small profit in Q4 2019. The first two quarters of 2020 will be important for their performance and the price of silver.

They have debt issues, so they are on a tight leash. They lose their top-pick status if their share price drops below $2. But it should be okay if the silver price remains above $17. They have huge resources and excellent long-life mines. This should be a 5-bagger if silver prices trend. They have two large silver projects to build in Montana.

There are few mid-tier producers with their resources and pipeline of projects. It looks pretty good as a high-risk speculation bet on higher silver prices. However, management has been a poor performer. Let me explain why I gave them such a poor grade:

- Their current company presentation is from October, and it is now January. Quality companies keep their presentations up to date.

- On page 4 of their current presentation, they give their performance for 2018! Who cares about 2018? I want to know about 2019.

- The current presentation claims that they are a low-cost producer with high margins. In fact, they lost money for the first three quarters of 2019.

- The current presentation does not mention their two large Montana projects, which are both worth $1 billion, in my opinion, at higher silver prices. Plus, the resources for these two projects are excluded from the presentation. Why?

- If they are a low-cost producer, then why are the hedging production using a put option?6) How did they allow debt to reach $584 million and large debt payments in 2021 to become due?7) They say that their objective is to reduce the Debt to EBITDA Ratio to 2.5. However, why don't they have an objective to reduce debt to zero and use it only to build mines and pay back the debt quickly?

- They want to pay a dividend, yet they have a huge debt. Why even have a dividend policy until the debt is paid off?

- Hecla has acquired many companies recently, including Mines Management, Revett Mining, and Klondex Mines. Instead of growing production methodically and accretively, they have blown up their balance sheet.

- My only conclusion after following this company for 15 years is that they are not shareholder-focused. That said, this is one of my largest holdings.

IAMGold (Analyzed 5/3/2020)

IAMGold Corp is a large mid-tier producer, with production at 750,000 oz. They have 4 operating mines in Suriname (northern South America), Canada (Quebec), Mali, and Burkina Faso. They are building a large gold mine in Ontario (Cote with 7 million oz) and spending millions on exploration and advancing properties. I consider this a growth stock. Their cash costs are currently about $900 per oz (forecasted to go down), with all-in costs (free cash flow) around $1300 per oz. That gives them around $200 million in free cash flow at $1500 gold.

They also have two additional development stocks in West Africa. Boto (Senegal) is 1.5 million oz at 1.8 gpt, and Sibanye (Mali) is 1 million oz at 1.7 gpt. Plus, they have a few more exploration plays that could become mine. They are giving guidance to reach 1.2 million oz of production in 2022, with all-in costs (free cash flow) of $1100 per oz. These numbers seem optimistic. I'm expecting 1 million oz at $1200 per oz.

Their balance sheet is okay, with $864 million in cash and $404 million in debt. This stock is undervalued, with an FD market cap of $1.7 billion. It’s a good income investment for future dividends. In fact, this stock has 5 bagger potential in the long term at higher gold prices. If that happens, your dividend could be around 5% in the future if you invest today. They were valued at $23 a share in 2011. I expect them to be high flyers again.

Their only red flag is the location of some of their producing mines in West Africa (Mali and Burkina Faso). While both countries are safe today, they have long-term political risks. You could consider their debt a red flag, but as long as they do not add any more debt, their balance sheet is pretty strong for the company's size. Plus, with their cash flow, they should clean up their debt.

MAG Silver (Analyzed 11/14/2020)

MAG Silver has an excellent silver project in Mexico. Their Juanicipio project is a JV with Fresnillo, and they have a 44% interest. Production should begin in Q4 2020, with a 19-year mine life (likely to be increased). Mag's share will be about 5 million oz of annual silver production (more than the first 5 years) at nearly zero cash costs. At $16 silver, they will have about $70 million in free cash flow. At $50 silver, they will have $200 million in cash flow. The zero costs are from offsets in gold, zinc, and lead. Juanicipio has a very high grade (10 to 15 opt) and a high silver recovery rate (94%). The CAPEX is only $300 million; Fresnillo is the operator and will pay for 56%. Mag's remaining share of the CAPEX in 2020 is $126 million, with $94 million in cash. So, there will be a little bit of dilution in 2020. Juanicipio is growing in size, and they already have several additional discoveries. This mine is going to grow in size. They also have an extensive pipeline of projects and are drilling several: Salamandra, Cinco de Mayo, Pozo Seco, Jose Manto, Mojina, and La Esperanza. The odds are good they will build a few more mines. Mag Silver has the potential to be a huge company. This stock has exploded to an FD market cap of $1 billion. That's one of the highest market caps for a non-producer. It seems pricey, but I like it as a combination of an income and growth stock. What are they going to do with all of that cash flow? They likely will have a high dividend. Plus, they could acquire additional producing mines and become a growth stock. The red flag for Mag Silver is they are not building or operating Juanicipio. This means we have no idea if they can build and operate a second mine (or want to). For this reason, my concern (and worst fear) is they will spin out Juanicipio and remain an exploration company. That would be the easy road for their management team.

Pan American Silver (Analyzed 6/4/2020)

Pan American Silver is one of the largest silver producers. They get about half of their revenue from silver production, about a quarter from gold, and the rest from base metals (zinc, lead, and copper). They recently acquired Tahoe Resources and joined the ranks of silver miners who have diversified into gold.

The combined resources of Pan American and Tahoe are huge. They have about 1.3 billion oz. of silver and 20 million oz. of gold. In 2020, they will produce about 22 million oz. of silver and 500,000 oz of gold. Plus, this does not include the Escobal mine in Guatemala, which has had political issues. If Escobal resumes production, that adds 20 million oz of annual silver production at low cash costs.

I tried to inform people that this stock was a bargain under $15 (it was my favorite stock under $15). Now it has broken out to $27 and is not so cheap. I’m still expecting to see it reach triple digits, although that will require much higher gold/silver prices and Escobal back in production.

In addition to being a bit pricey, it has a few other red flags. They mine in Guatemala, Bolivia, Argentina, and Peru. They also have producing mines in Mexico and Canada. Overall, the location risk is significant. But I have confidence that management can find a way to grow. Also, their all-in (break-even) cost per oz for silver is around $15 to $16. That’s not low. But if Escobal comes back online, their overall costs will be much lower.

Gold production is currently giving them a nice cushion. They have solid cash flow from their expected 500,000 oz of production in 2020, with all-in (break-even) costs of around $1200 per oz. Plus, they have a pretty good balance sheet, especially for a company of their size. This is because their Chairman (Ross Beaty) is shareholder-friendly and understands the value of a good balance sheet.

Looking at potential free cash flow, Pan American is a standout. At $100 silver and $2,500 gold, you could get 45 million oz. (if Escobal is re-started) x $50 per oz free cash flow = $2.3 billion in free cash flow. Plus, 500,000 oz. x $800 = $400 million. That is nearly $2.7 billion in annual free cash flow. If they get valued at 10x free cash flow, that will make them a potential $27 billion market cap. The FD market cap is currently $6 billion.

Average Exploration Cost per oz. for Majors.

Gold miners with the lowest AIS Cost. (We excluded royalty and streaming companies such as Royal Gold and Franco-Nevada as well as large gold miners that report only on a cash cost basis, such as Randgold Resources.)

- Barrick Gold (ABX): $745 an ounce.

- Newmont Mining: $970 an ounce.

- Goldcorp (GG): $850 an ounce.

- Agnico Eagle Mines: $875 an ounce.

- AngloGold Ashanti: $1,075 an ounce.

- Kinross Gold: $975 an ounce.

- Gold Fields: $1,020 an ounce.

- Yamana Gold: $900 an ounce.

- B2Gold: $955 an ounce.

- Eldorado Gold (EGO): $860 an ounce.

These gold miners have done a good job of reducing their costs over the past five years as gold prices have retreated from nearly $1,900 an ounce in 2011. If gold remained near $1,300 an ounce, all 10 of these mid- and large-cap gold-mining stocks would be healthfully profitable.

The picture below clearly shows that the PROFIT made by Miners will be GEYSER as soon as Gold initiates the next upleg. Note that profits will jump even when we only have a small price increase of Gold over the next months.

|

1. Barrick Gold

Far and away, the most cost-efficient large miner is Barrick Gold, with a midpoint of its 2017 AISC forecast of $745 per ounce. Barrick lowered its AISC forecast on three separate occasions in 2017, leaving this Fool to believe that the company could be a bit conservative with its cost guidance.

Barrick Gold has two major factors working in its favor. First, it's taken the time to focus on reducing capital expenditures and debt. At the end of 2014, the company had $13.1 billion in debt, but by the end of 2016, Barrick had reduced its total debt to $7.9 billion. By 2018, Barrick anticipates reducing its debt to just $5 billion, which means lower interest expenses and more flexibility should it feel the need to acquire new properties. As a bonus, less than $200 million of its remaining debt matures before 2019.

In terms of capital expenditures, Barrick came in under target in 2016 at $1.12 billion, and the company has lowered its capital expenditures by about $225 million in 2017 and 2018 from its initial guidance. This, too, can have a positive impact on AISC.

The other factor working in its favor is the potential for organic mine expansion. For example, the Goldrush mine in Nevada is expected to add an estimated 440,000 ounces of gold a year by 2021. Meanwhile, Turquoise Ridge is expected to see an expansion of its underground mine. These are just two of many examples where Barrick can boost its output without affecting its AISC all that much.

2. Goldcorp

For those of you who regularly follow gold stocks, seeing Goldcorp among the most cost-efficient miners should be no surprise. Goldcorp has long focused on boosting efficiency, being prudent with its capital expenditures, and utilizing its byproducts to offset its gold-mining costs.

Last year, Goldcorp lowered its AISC to $856 an ounce, notably lower than the $894 reported in 2015. Goldcorp has managed this about-face by focusing on its most promising projects and looking for ways to reduce its costs organically. For instance, it's been analyzing its properties in an effort to save $250 million annually in cost savings by 2018. Thus far, it's identified about $150 million in savings and wound up realizing $100 million in annual savings last year.

At the same time, Goldcorp is focused on ramping up production at Cerro Negro in Argentina and Eleonore in Quebec. After producing 382,000 gold ounces at Cerro Negro last year, Goldcorp is targeting an additional 28,000 ounces in 2017, largely a result of development rate improvements. At Eleonore, production is estimated to grow by a double-digit percentage to 315,000 gold ounces from 278,000 in 2016 as the company continues to ramp up operations. Full production isn't even expected at Eleonore until sometime in 2018.

Significant byproduct recoveries at Musselwhite, Eleonore, Penasquito, Red Lake, and Cerro Negro have also been instrumental in keeping Goldcorp's costs down. I'd expect it to remain a low-cost leader within the industry.

3. Eldorado Gold

Eldorado Gold is another mining company that surprised Wall Street last year by producing an AISC of $900 an ounce versus its original AISC guidance of $940 to $980 an ounce.

What we're seeing right now is a major transformation underway with Eldorado Gold. The company disposed of its non-core assets in China last year, selling its 82% stake in Jinfeng and closing its sales on both White Mountain and Tanjianshan in November. The sale better help Eldorado Gold focus on its core mines in Greece and Turkey, as well as prepare for the start of commercial production at Skouries in Greece by 2019.

Gold and copper mine Skouries has the potential to be a real game-changer for Eldorado. After multiple delays, construction of the mine is underway and, at least for now, on track. The company expects to spend $170 million to $200 million on capital expenditures at Skouries this year, which is lower than it forecasted in September. The company attributes the flexibility of its capital plan and ongoing cost initiatives to helping to push its spending below budget.

Once online, Skouries is expected to have an estimated 25-year lifespan that'll wind up producing more than 3 million ounces of gold and close to 1.5 billion ounces of copper. In fact, the copper byproduct during the first nine years of the mine is expected to push its sustaining and operating cash costs into the negative.

Most importantly, Eldorado ended 2016 with $883.2 million in cash and cash equivalents following the divestiture of its non-core assets. In just one year's time, it went from a $300 million net debt position to more than a $290 million net cash position. This added flexibility should be a good thing for the company and shareholders.

Gold mining companies of South Africa.

- I have made quite a bit of money in the past on some of the old gold bug favorites like Harmony Gold (HMY), Goldfields (GFI), Caledonia Mining (CMCL), Sibanye (SBGL) and Durban Deep. It is now known as DRD Gold (DRD), which has transformed itself into a tailings miner, a shadow of its former self, with all those operations still mired in South Africa.

- Many South African miners are currently reinvesting for the future, which means desperately trying to get out of South Africa as fast as possible.

- AngloGold Ashanti (AU) is quietly trying to divest all South African properties.

- Goldfields (GFI) is another example; its largest production is coming out of Australia, but most of its reserves are in South Africa. They are probably one of the miners that will survive the new mining charter turmoil, but at what cost to them and the others is unknown.

- The BLACKS, alias the South African government, is trying to push a mining charter, which is a form of affirmative action on steroids mandating black ownership of all mines to 30%. The charter was passed, but the pushback was severe and hurtful to the industry, so it has since been put on hold for the time being. I doubt the desire for the mandate will ever go away, leaving an unknown factor to contend with that non-South African miners simply do not have. [What happens in Zimbabwe doesn't stay in Zimbabwe but also happens in South Africa 10-15 years later...and I KNOW what I am talking about!]

- There are better ways than a foolish mandate to share the wealth besides bankrupting the whole industry and better places to put hard-earned capital. Therefore, exposure to South Africa puts you off my list of companies I want to own. If you own any of them now, you better convert these into Non-South-African.

Gold Cycles:

The Gold and Silver sector keeps consolidating its HUGE 2015-2016 bottom...a lifetime opportunity! [November 2016]

|

|

|

| click to enlarge |

November 2015 book values:

- Coeur D'Alene Mines Corporation's book value per share for the quarter that ended in Sep. 2015 was AUD 11.24 or US$ 7.85. The current market price is $ 2.50.

- Yamana is the cheapest. At $ 1.80 you buy a value of $ 6.66.

- Franco Nevada is the most expensive one: $47 buys only $21 of tangible value.

This is what happened during the Great Depression (1929 - 1939). Homestake went up from $ 50 to $ 500!

From 1929 to 1939, Homestake Mining, which you might think of as a proxy for senior [gold] mining stocks, rose from $80 per share in October 1929 to $495 per share in December 1935, which was 519% and it paid large annual cash dividends while gold was only increased from $20/oz to $35/oz in 1933 by government decree. In 1924 dividend was $7 in 1935 dividend was $56 or more than the market value of the stock in 1924.

This is what happened in the 1970s-1980s: check the last column for the share price gain in % - These are historic yields...they show how interesting Gold and Silver shares can get...up to 14% yield...

| Click to enlarge | |

This is the beginning of what is to happen from 2009 to 2019. Check the last columns

|

|

|

|

|

|

|

|

|

Note: Gold and silver mines are cheap as chips... |

|

|

AEM shares have been slashed by nearly 50% over the past year, while earnings have continued to rise from 69c in 2009 to $1.97 in 2011 and projected by analysts to rise to $2.42 by 2013 at a respectable annual growth rate of 10.8%. As a result, its shares are undervalued, trading at 14-15 forward P/E and 1.7 P/B compared to averages of 20.5 and 4.7 for its peers in the gold mining group. |

AUQ reported a good Q4 at the end of March, beating earnings estimates (31c v/s 14c), with revenues higher year-over-year by 118% to $154.8 million. Also, at the end of March, the company guided production targets, cash costs, and capital expenditures for 2012 through 2014. The shares have been flat since the report and trade at a current 9.0 P/E and 1.1 P/B, compared to averages of 17.3 and 1.9 for its peers in the gold mining group. |

|

|

|

|

|

|

Paramount has two primary projects: the San Miguel deposit in Mexico and the Sleeper Mine in Nevada. ZPG shows some 8.4 million ounces of gold equivalent between the two projects. That’s about $38 an ounce. That’s pretty cheap, especially considering country risk. Paramount has two primary projects: the San Miguel deposit in Mexico and the Sleeper Mine in Nevada. ZPG shows some 8.4 million ounces of gold equivalent between the two projects. That’s about $38 an ounce. That’s pretty cheap, especially considering country risk. |

Gold Resource Corporation (GORO) is a mining company focused on the production and pursuing the development of select, high-grade gold and silver projects that feature low operating costs and produce high returns on capital. The Company has 100% interest in four potential high-grade gold and silver properties in Mexico's southern state of Oaxaca. The Company is interested in four properties: the El Aguila property, the Las Margaritas property, the El Rey property, and the Solaga property. All of these properties are in the exploration stage and have no probable reserves. The company is based in Denver, Colorado. |

More on Paramount...click to enlarge. More on Paramount...click to enlarge. |

|

| Hecla Mining Company (HL) is a leading low-cost U.S. silver producer with operating mines in Alaska and Idaho and is a growing gold producer with an operating mine in Quebec, Canada. The Company also has exploration and pre-development properties in five world-class silver and gold mining districts in the U.S., Canada, and Mexico, and an exploration office and investments in early-stage silver exploration projects in Canada. [Coeur is a better choice] |

Kinross Gold Corporation (KGC) Founded in 1993, Kinross Gold is a senior gold mining company with a diverse portfolio of mines and projects in the United States, Brazil, Chile, Ghana, Mauritania, and Russia. Headquartered in Toronto, Canada, Kinross employs approximately 9,300 people worldwide. The Company is focused on delivering value through operational excellence, balance sheet strength, disciplined growth, and responsible mining. Kinross has enjoyed a great track record of late, having met or exceeded guidance for 5 consecutive years. In 2016, they generated 465 million in free cash flow and paid off over 200 million in debt last year. They still have around a billion in debt out there that I would like to see continually addressed... Currently, they are at a 4 billion market cap and are a nearly 3 million ounce producer, with 1.1 billion in cash. |

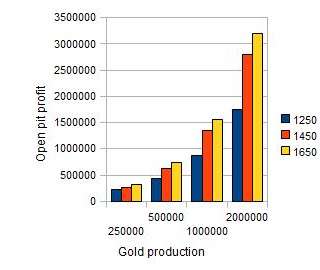

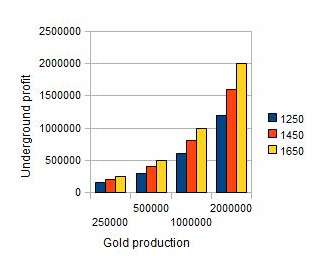

Goldmines and what it costs to dig for it and what it yields (June 2010)...consider this in relation to the actual price level of Gold and Silver shares in general. Note that profit has almost doubled....The maximum underground exploitation exploitation cost is $ 750.

| ounces mined | gross @ $ 1,250 | gross @ $ 1,450 | gross@ $ 1,650 | gross @ 1750 | underground cost $ 650/ounce* |

open mine cost $ 375/ounce* |

| 250,000 oz | $ 312,500 | $ 362,500 | $412,500 | $437,000 | $ 162,500 | $ 93,750 |

| 500,000 oz | $ 625,000 | $ 725,000 | $ 825,000 | $875,000 | $ 325,000 | $ 187,500 |

| 1,000,000 oz | $ 1,250,000 | $ 1,450,000 | $ 1,650,000 | $1,750,000 | $ 650,000 | $ 375,000 |

| 2,000,000 oz | $ 2,500,000 | $ 2,900,000 | $ 3,300,000 | $3,500,000 | $ 1,300,000 | $ 750,000 |

* 2014 average underground exploitation cost are double or $ 1,200 per troy ounce.

| ounces mined underground | profit @ $ 1,250 underground | profit @ $ 1,450 underground | profit @ $ 1,650 underground | profit @ $ 1,750 underground |

| 250,000 ounces | $ 150,000 | $ 200,000 | $ 250,000 | $ 274,500 |

| 500,000 ounces | $ 300,000 | $ 400,000 | $ 500,000 | $ 550,000 |

| 1,000,000 ounces | $ 600,000 | $ 800,000 | $ 1,000,000 | $ 1,100,000 |

| 2,000,000 ounces | $ 1200,000 | $ 1,600,000 | $ 2,000,000 | $ 2,200,000 |

Gold miners always mine the marginal gold ore.

| ounces mined open pit |

profit @ $ 1,250 open pit |

profit @ $ 1,450 open pit |

profit @ $ 1,650 open pit |

profit @ $ 1,750 open pit |

| 250,000 ounces | $ 218,750 | $ 268,750 | $ 318,750 | $ 343,250 |

| 500,000 ounces | $ 437,500 | $ 631,250 | $ 731,250 | $781,205 |

| 1,000,000 ounces | $ 1,250,000 | $ 1,356,250 | $ 1,556,250 | $ 1,656,250 |

| 2,000,000 ounces | $ 2,500,000 | $ 2,806,250 | $ 3,206,250 | $ 3,406,250 |

The charts below show the exponential rise in profits.

We prefer to stay away from those Gold mines that Hedge gold production. Barrick moves to eliminate Gold hedges but seems to have problems in doing so...Barrick has announced that the company is not delivering the gold it has sold forward. The company is raising cash from the sale of the stock so that it might deliver cash instead of gold. I don't know if this is a default under the terms of the company's hedge contracts, but it is technically a default because gold was sold for future delivery, and the future delivery is not being made.

In theory, Barrick should have to go into the market and buy gold to deliver on its obligations instead of paying cash. Of course, this would blow the gold price sky-high and thus might bankrupt the company in the process. But this is not the end of the story because the counterparty to these hedges, probably JPMorgan Chase, no doubt also has obligations to deliver to some other entity the gold it was expecting from Barrick -- maybe a central bank. Will the counterparty also be able to settle its obligations in cash, or will significant quantities of gold have to be purchased? Barrick may be getting off the hook, but this technical default creates a shortage of physical gold.

This is explosive news for the gold market. The run on the Bank of the Gold Cartel is unfolding. Much more gold has been sold than can be delivered. The implications for the gold price are mind-boggling.

|

Evidence suggests that during the initial stages of a major crisis, gold and gold stocks usually follow the general market. It is only later on when the recessionary period is well underway, that gold and gold stocks begin to decouple from the rest of the market (look for more info and a longer-term perspective on the subject in our special report "gold and gold stocks within the 40-year cycle.") Following paragraph describes Homestake during and after the Great Depression. Over the course of the entire '30s, the Dow lost 40%, while Homestake was up 500%, all with only a modest adjustment in the gold price from $ 20.67/oz. to $ 35/oz. |

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the ex