Miners & Gold & SPX

July 23, 2024 - Gold and Silver versus Gold & Silver Shares and Stock Market Indexes.

Gold and Silver shares will go up when the time is up! Why do investors hesitate to buy when assets are cheap and rush in when prices are soaring? Gold shares are CHEAP as CHIPS. Note that it sometimes takes 2-3 years before a market trend sets. Markets can stay irrational for a longer time than the average investor solvent. Technically speaking, it looks like Gold will continue to outperform the Miners!

Gold and Silver shares will go up when the time is up! Why do investors hesitate to buy when assets are cheap and rush in when prices are soaring? Gold shares are CHEAP as CHIPS. Note that it sometimes takes 2-3 years before a market trend sets. Markets can stay irrational for a longer time than the average investor solvent. Technically speaking, it looks like Gold will continue to outperform the Miners!

"Also, see the section of Stock Market Indexes expressed in Real Money or Gold!"

"This time, however, looks different...Miners are UNDERPERFORMING compared to Gold = CAUTION!" It is important to realize Stock certificates have become dangerously digitalized, many "Transfer Agents" are in trouble, and Miners have to cope with rising energy prices and the hardship of these retard Green Environmentalists. Together with a lower gold/silver grade, this makes the sector less profitable.

People buying Gold at $252 in 1999 paid the lowest absolute price in a century. They were investors. People buying silver at $4 in late 2001 were buying at the lowest absolute price in 5000 years. They were investors. You can rarely get hurt buying at record lows when a commodity's price is below the production cost.

This is a disconnect, and maybe it's not an opportunity! Gold shares typically lead Gold during upswings, but maybe not this time!

|

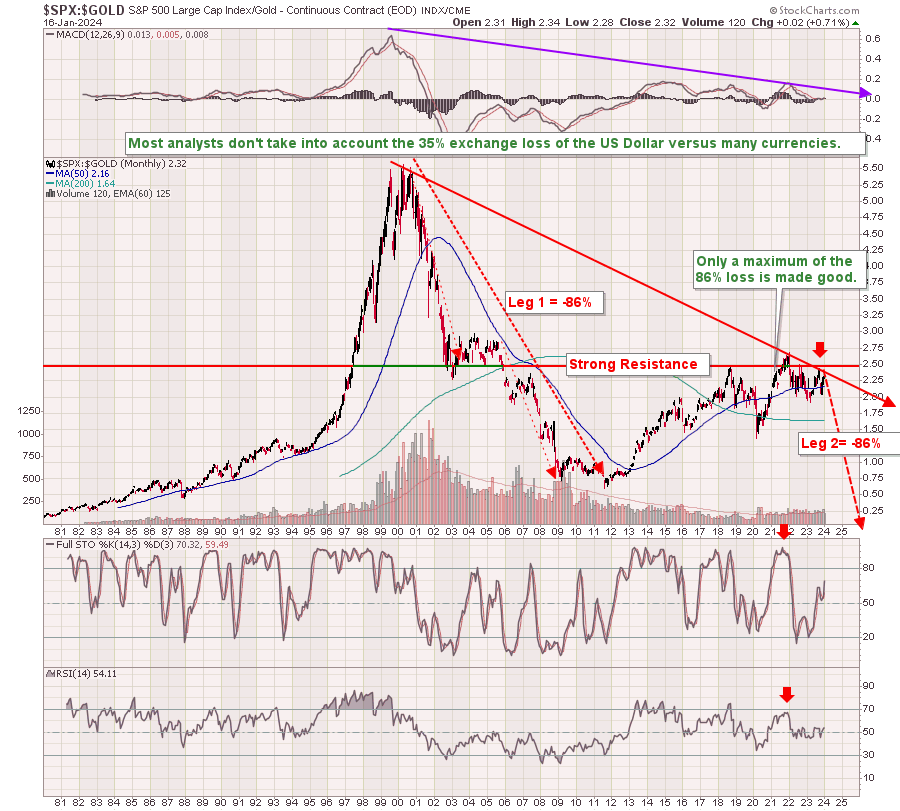

Gold shares and the SP500 - Note the down-sloping LT trend!

Gold versus the Stock Markets (SP500): From now on (August 2019), we expect Gold and silver to perform better than the Stock Markets.

Gold and Silver performed better over the past, particularly since 2001. Comparing over a longer period doesn't make sense at all, for obvious reasons. Also important is the future, what comes, and not the past.

©, All Rights Reserved - The contents of this report may NOT be copied, reproduced, or distributed without the explicit written consent of Goldonomic